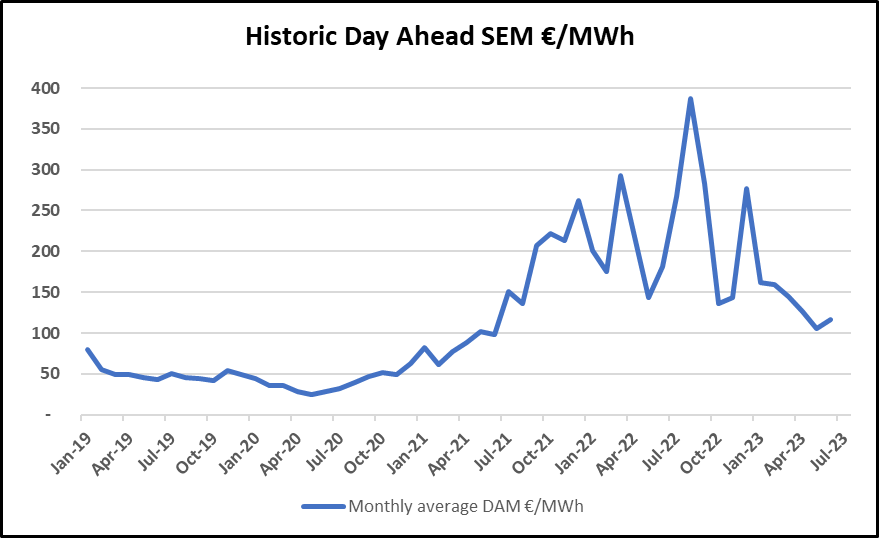

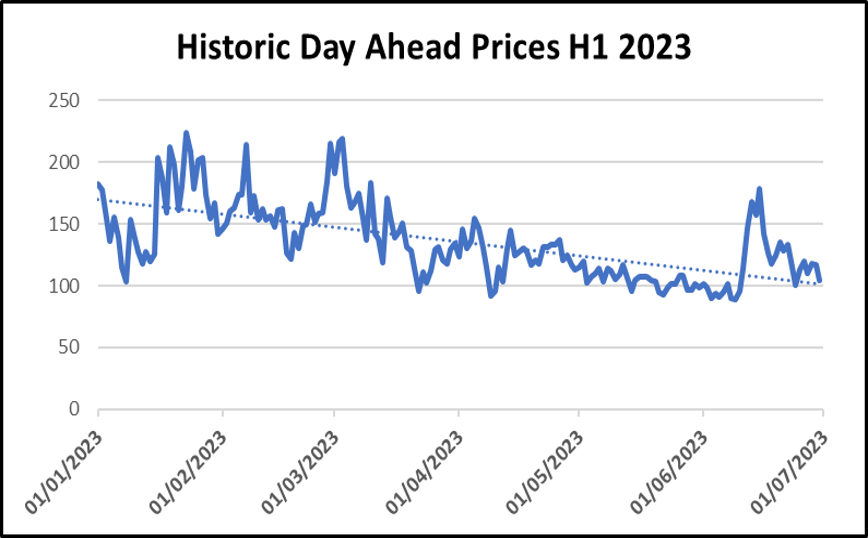

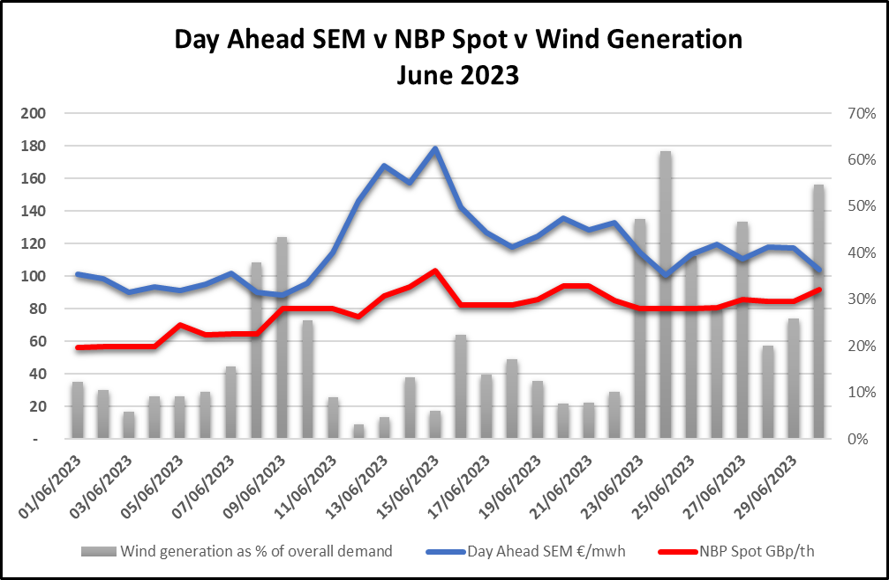

After a sustained bear run in Irish power prices from December 2022 until May, markets began to wobble in June. Average prices in the SEM Day Ahead rose 11% month-on-month. June outturn was €117/MWh, compared to €105 in May.

Upward price pressure during the month came from a combination of low wind generation and increased British gas prices. However, there is still optimism in the markets, and we expect that prices will bobble along at current levels for the remainder of the summer season at least.

Gas – Pricing & Supply

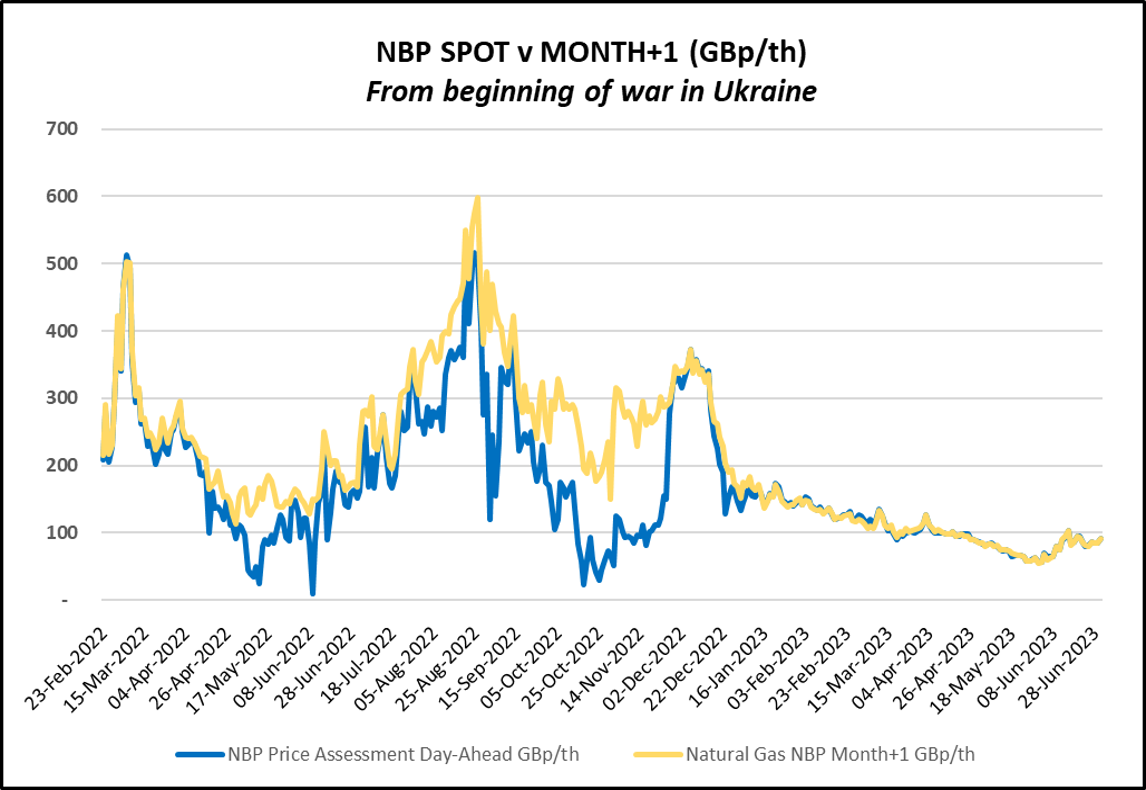

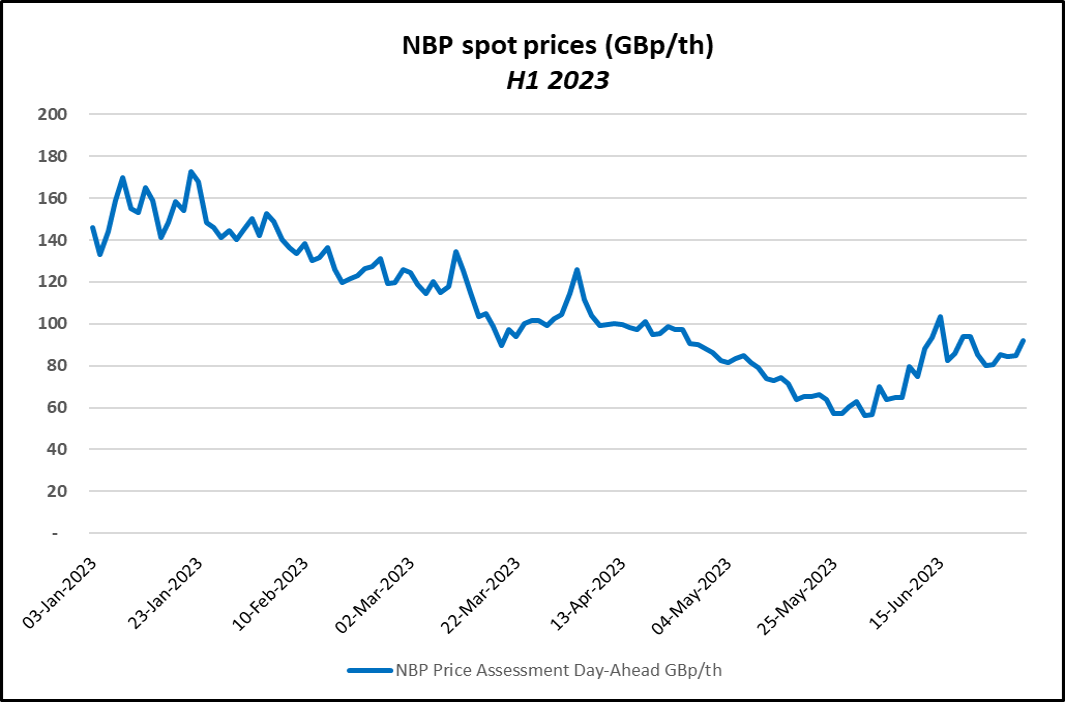

- Prices on month+1 British gas contracts remain at levels not seen since before the invasion of Ukraine in March 2022.

- Events in Russia and Ukraine earlier in the month have had minimal impact on NBP prices. This is evidence of how far Europe has come on removing its reliance on Russian energy imports.

- NBP spot and month+1 prices appeared to find a floor during the month, as volumes of LNG cargo arrivals dropped off significantly

- Volatility on the NBP increased significantly in June, with daily swings of 10%+ in either direction commonplace throughout the month.

Gas – Consumption & Storage

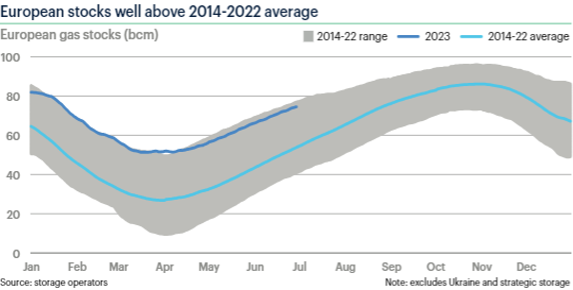

- European storage were 74% full at end of June. This is 22 percentage points higher than at the same point in 2022.

- Despite recently slowing down, even at current injection rates, the EU November aggregated storage target of 90% fullness is likely to be reached by August.

- 90% storage targets by 1 November are achievable even without Russian pipped gas, that was available at this time in 2022.

- One risk here is that gas prices in Europe are now back below Asian levels therefore making Asian delivery more attractive for LNG. The LNG will need to continue to arrive if storage targets are to be met.

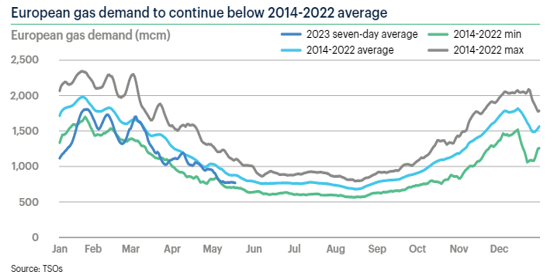

- Gas demand has been lower than average of late. See chart above, obtained from ICIS. This is even more encouraging, as wind generation has been down over the last 2 months, which should naturally increase demand for gas powered generation.

June Review – EU Market Reform

Reform is needed in European energy markets, to enable a future grid loaded with renewable power generation, and to safeguard against crisis such as last years, when Russia invaded the Ukraine and Russian pipeline gas was removed from the EU grid network. The EU Commission President, Ursula von der Leyen set out ambitious targets, to reduce the impact of sharp movements in gas prices and their impact on power prices, during the early days of the war.

As is inherent in EU policy decisions, there are many vested interests at play and a solution remains elusive. This is an immensely complex area and talks on 30th June failed to provide an agreement between member states.

It appears the main sticking point is around the use of state subsidies to support indigenous power generation, with French Nuclear being flagged as a prime example.

France supports the subsidy proposal and has suggested restricting the use of such subsidies risks undermining energy security and efforts to protect consumers from volatile power prices.

However, other member states, including Germany, have warned that excessive use of subsidies could distort the EU market by giving some states a competitive edge.

Renewables

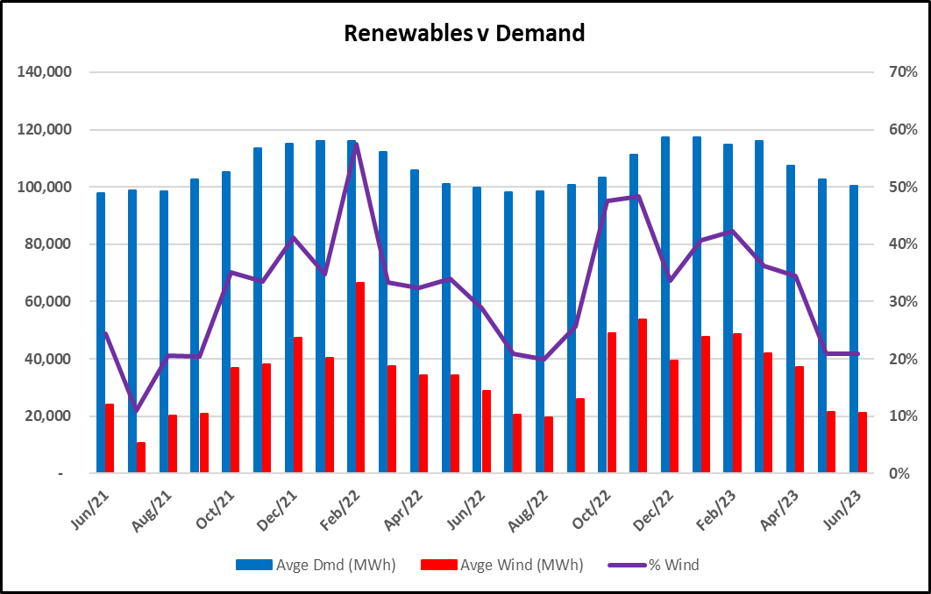

Wind generation was relatively low in June and contributed an average of just 21% of the Irish Generation Mix across the month.

This follows an identical result in May and is bringing prolonged upward price pressure to Irish power markets. See graph below.

A significant uptick in power prices came mid-month, when wind was low and gas prices were up. Gas prices too are directly influenced by wind output in the UK and Ireland, so the impact of prolonged lower wind output has a double impact here. See graph below.

Generation Capacity

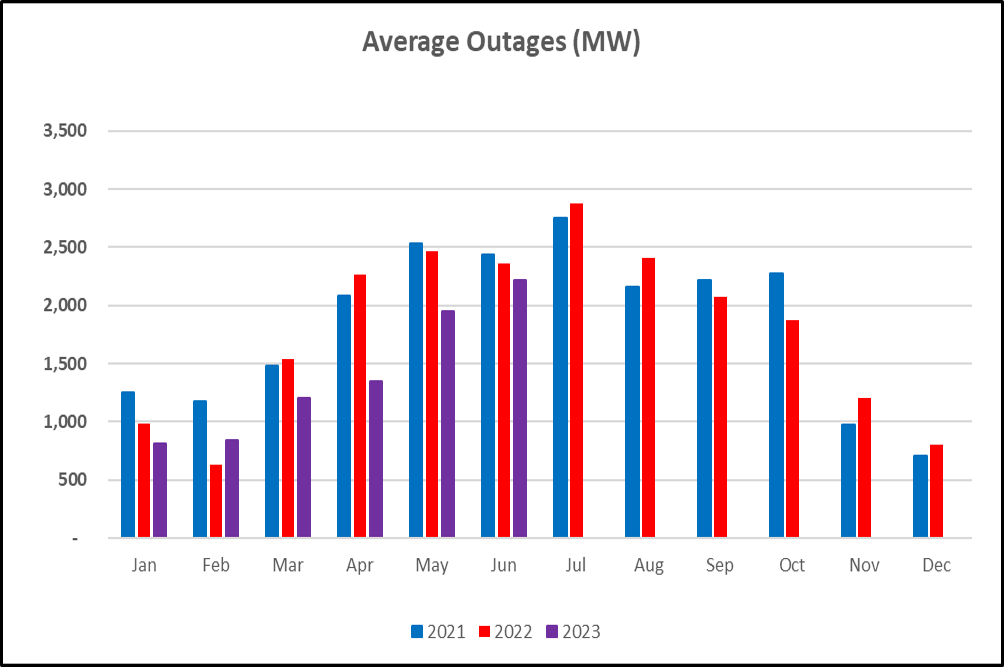

- Although an amber alert was issued during the month, and outages in June ‘23 were higher than they were in May ‘23, total outages in the month were lower than the previous 2 comparative periods, for the fourth month in succession.

- That amber alert was issued by SEMO on Monday 12 June, warning the system of an anticipated shortfall in generation. That shortfall was not helped by an unusual combination of low wind together with low solar generation. Thankfully, the amber alert was subsequently lifted later that day.

Forecasts – Power Forward Prices

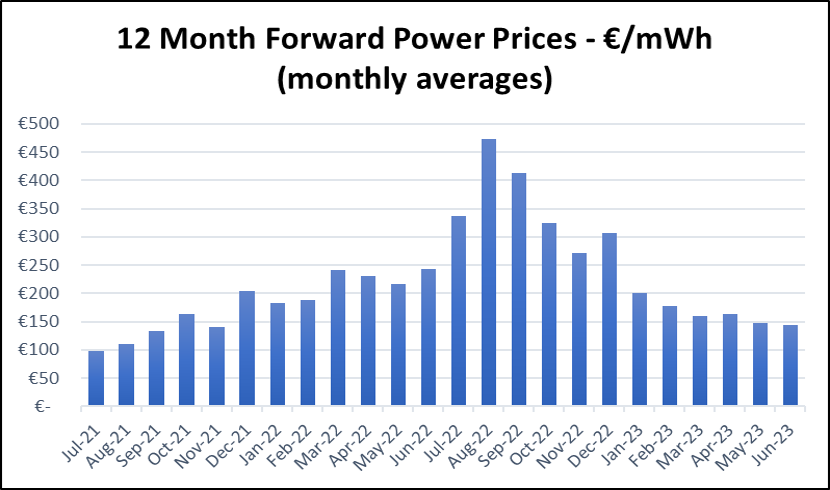

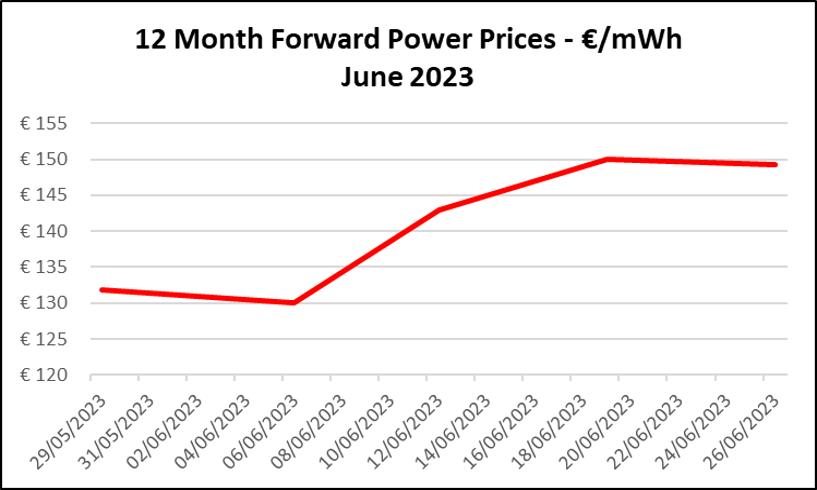

- Falling forward power prices appeared to hit a floor in June, as a combination of disruptions to Norwegian pipeline gas supply and significantly reduced LNG cargos arriving in UK ports brought the nervousness imbedded in the system to the fore.

- Forward prices are approximately 2.5x the previously accepted norms, at around €150/MWh. As comfort over storage levels builds, some of the risk premium is now shifting further along the price curve, out past the coming Winter, and later into 2024.

Forward price watch; 12 months and beyond – China long, while Europe scraps in the spot market.

- China signed a 27-year agreement with QatarEnergy in June, under which China will purchase 4 million metric tons of liquefied natural gas (LNG) a year from the Gulf Arab state. The two nations have already signed other such deals during 2023.

- In this recent deal, China has also taken an equity stake in the eastern expansion of Qatar’s North Field LNG project, further re-enforcing the two countries energy ties.

- China’s willingness to commit to long term to gas purchases contrasts with a reluctance to do so in Europe, because of commitments on green energy targets (and related penalties) over the next decade.

- This leaves European power prices particularly vulnerable to the whims of the highly price sensitive spot gas market

- The premium paid for LNG spot cargoes in Europe has been shifting above and below its Asian equivalent. This position is seen as necessary to attract in price sensitive LNG to the continent. The more that Europe operates in the spot markets, as opposed to securing long term deals, the more that this spot premium will impact power prices here.

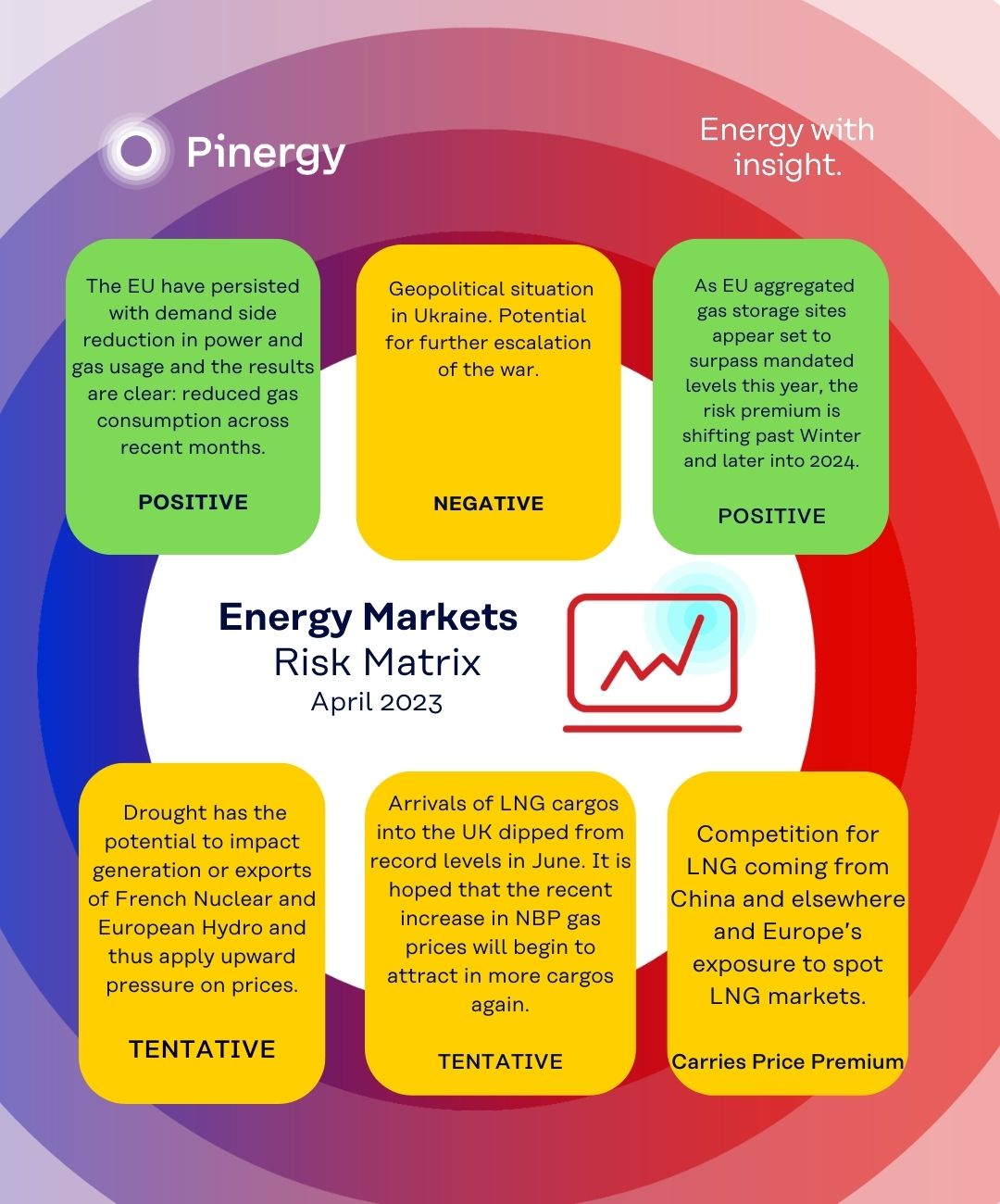

Pinergy Risk Matrix

We have compiled a list of the key factors we feel have the highest potential to influence power prices over the coming 12 months and rated as follows:

- Green = Price reducing impact and highly probable.

- Amber = Risk of increased power prices and of lower concern.

- Red = Significant risk to 12 month forward price outlook, with medium to high probability.