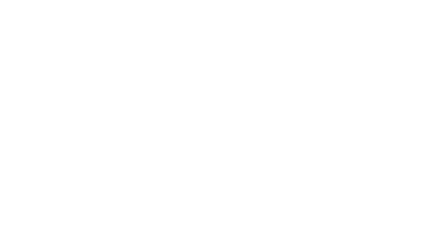

Average power in March went back to bullish mode from recent drops month on month. Price increased 72% on February at a whopping €301/mwh.

Spiralling gas prices arising from the Ukraine war, together with low wind output, paradoxically created the perfect storm!

How Gas impacted the Energy Markets across March

- Gas prices spiked in early March on foot of the war outbreak, as markets tried to ascertain the effects of war, threatened sanctions, Russian responses. Markets have calmed somewhat since then for the following reasons:

- Gas continues to flow Westwards in decent volumes

- EU has not sanctioned gas producers like Gazprom. It appears EU is unlikely to do so.

- LNG continued it’s record breaking delivery schedule in March.

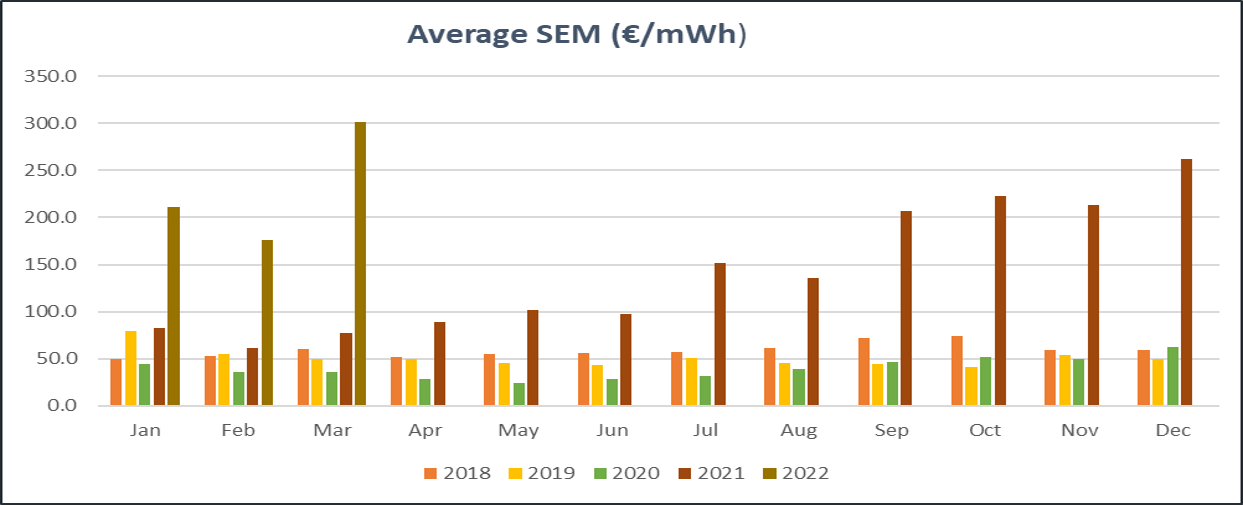

- LNG and mild weather continued to help the European storage situation, bringing storage within historic averages.

Commercial Gas Stocks

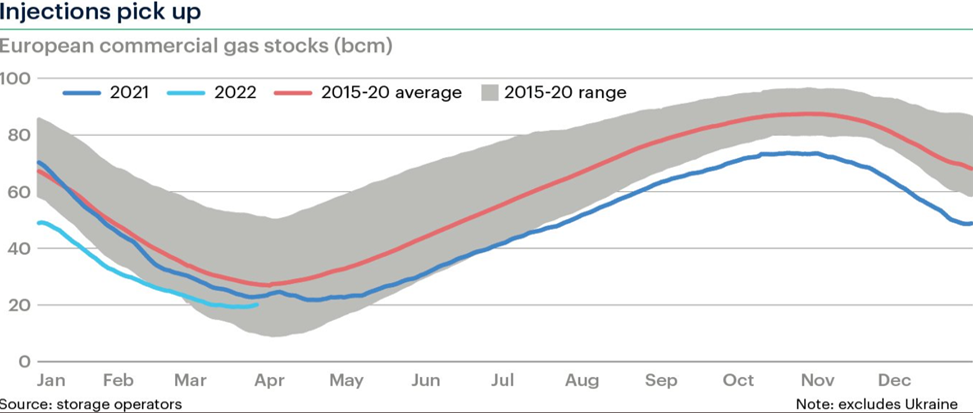

Gas Pricing Dec 21 to Apr 22

Is Putin playing a game of Chess or Poker?

- Gas prices very volatile since war began.

- Initial spike, calm as deliveries Westward continued, spike to 500p/th, dropped again on peace talk hopes, rose to 300p/th on standoff over payments in Roubles.

- Markets have fallen since as Rouble standoff is by and large bluff and won’t take effect until mid May at least.

- EU/US announced 15bcm (increasing to 50 bcm) LNG deliveries to Europe, as Europe weans off Russian gas.

- Centralised EU procurement of gas commencing.

- Initial EU talks about de-coupling power prices from gas prices

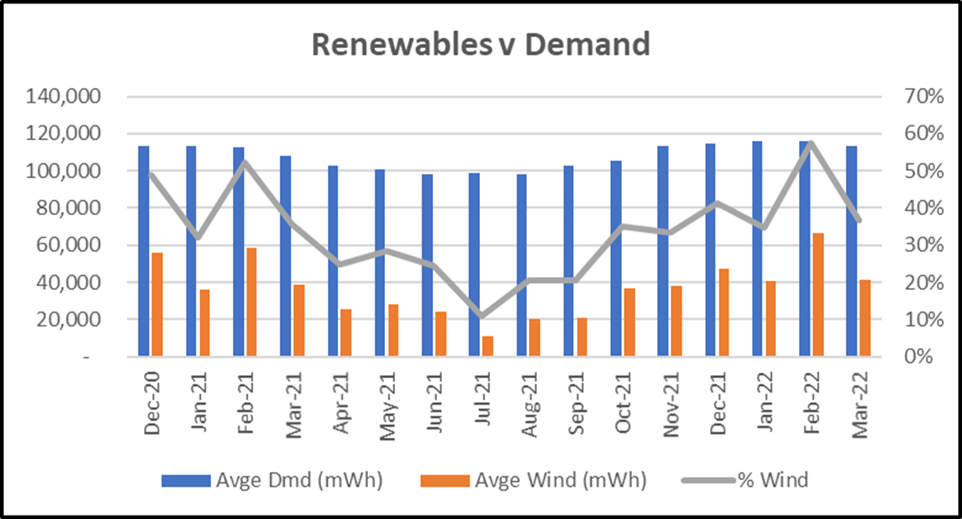

March disappointed from a renewables perspective

- March disappointed from a renewable generation perspective. Renewable only contributed 33% of demand, down 44% on February.

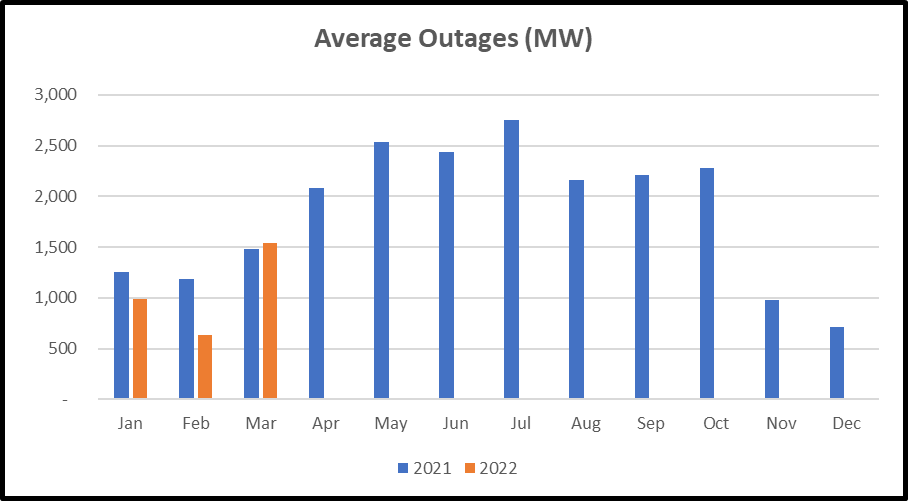

Generation Capacity is improving but least of the worries

- Outages have increased on Jan and Feb lows, but continue at a reasonable level.

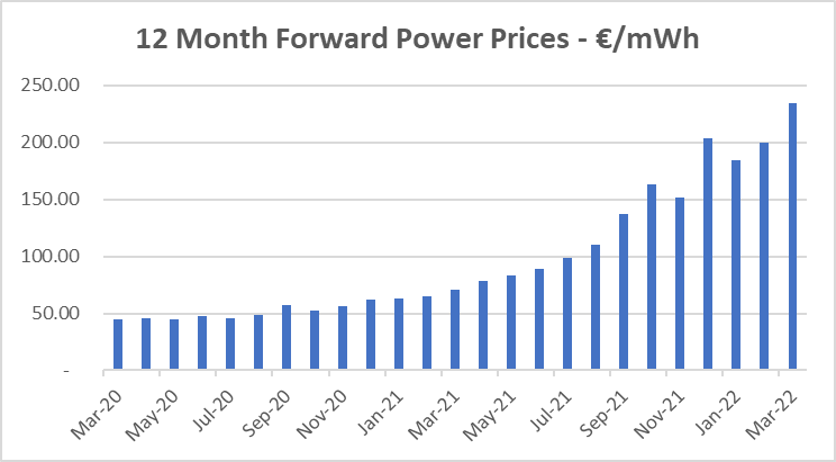

What’s the forecast for the next 12 months?

- Forward prices were lowering following December’s high and improving gas storage situation in Europe.

- The breakout of war, European sanctions and markets fear of further sanctions against Russian energy exports has increased the risk premium in forward pricing.

- That premium will remain while the uncertainty of the Ukrainian situation remains.

Key market drivers for next 12 months

- Geopolitical situation in Ukraine – Negative

- Weather – Mild winter – Storage hasn’t been depleted as feared – Positive (so far)

- Pent up demand for and EU Mandated storage levels will impact Gas Summer refilling season – will support prices – Negative

- LNG deliveries will remain strong – US key source – Positive

- Moral and Political demand for sanctions on gas and oil – negative

Disclaimer

The contents of this report are provided solely as an information guide. The report is presented to you “as is” and may or may not be correct, current, accurate or complete. While every effort is made in preparing material for publication no responsibility is accepted by or on behalf of New Measured Power Limited t/a Pinergy for any errors, omissions or misleading statements within this report. No representation or warranty, express or implied, is made or liability accepted in relation to the accuracy or completeness of the information contained in this report. New Measured Power Limited t/a Pinergy reserves the right at any time to revise, amend, alter or delete the information provided in this report.