Energy Market Insights: The worst month yet!

December 2021 saw more record pricing

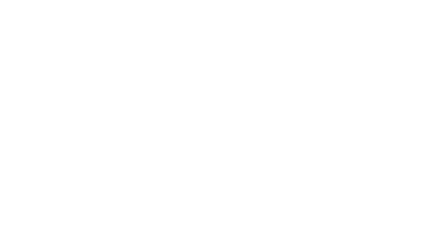

Average power increased again in December up 23% on November, coming in at €261/mWh, 320% on the same period in 2020. The energy crisis is still raging, unabated.

Notwithstanding the record prices, power prices did ease towards the month end with lower gas prices, milder & windier weather and lower demand.

Gas prices spiked in December

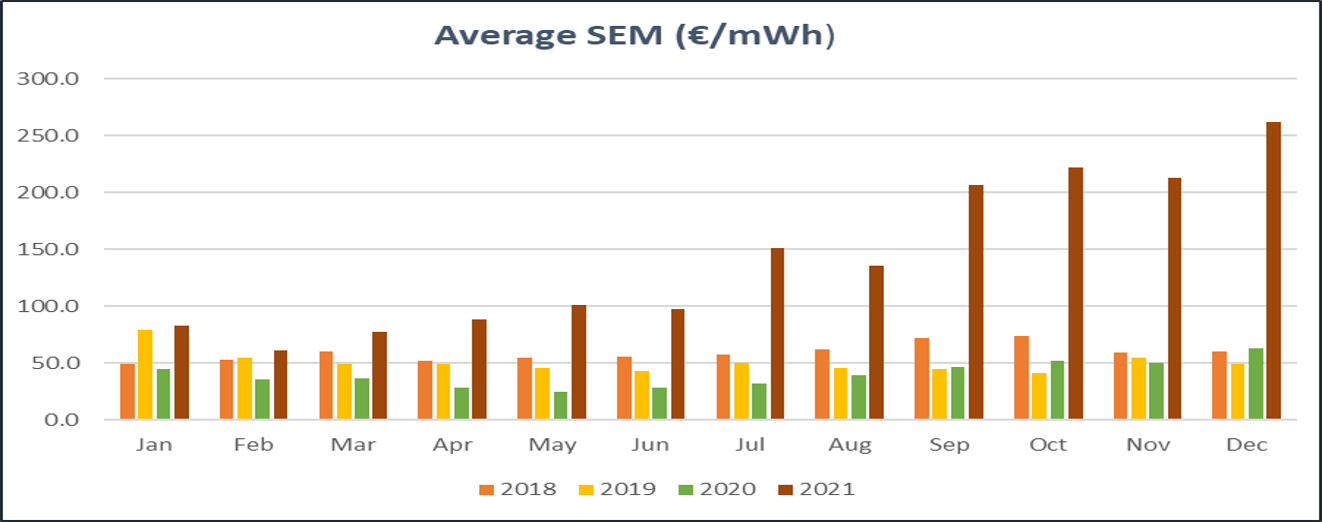

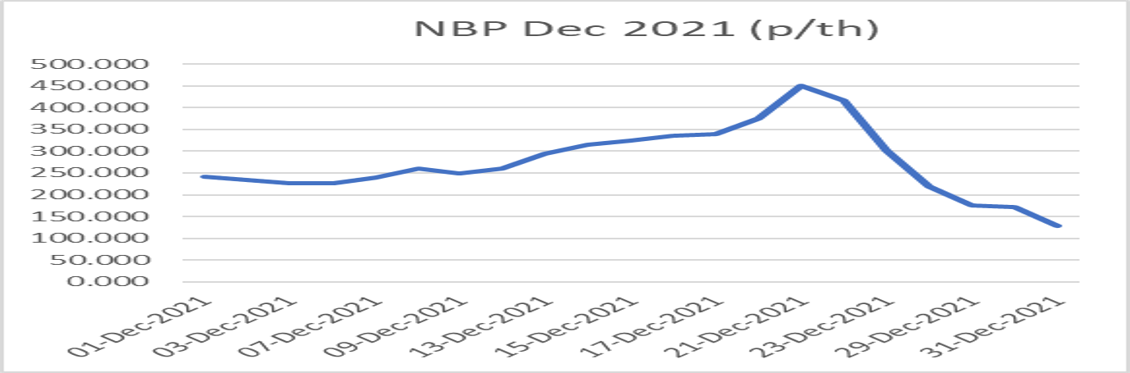

Power prices have been buoyed by strong gas prices. Day ahead Gas prices rose by 80% from 1 December to 21 December capping at a record mark of 450p/th. The since fell by 71% from 21 December to month end.

The increase to 21 December arose due to uncertainty about Gasprom’s deliveries to Europe. First, Gasprom ceased booking monthly capacity, then ceased booking day ahead capacity, then ceased booking within day capacity to finally gas commenced flowing Eastwards. All this spooked the market, causing gas prices to increase.

In response to spiralling gas prices, LNG deliveries attracted by the premium achievable in Europe diverted their course to Europe resulting in a flotilla of LNG tankers headed for Europe.

This flotilla, gave the market succour resulting in a collapse in gas prices towards year end.

In addition, mild weather experienced across Europe, gave an opportunity for storage injection to occur increasing Europe’s multi year low storage levels. At year end, they were approximately 55% full.

Finally, Gazprom booking capacity westwards for January, added the bearish movements in gas prices in the latter part of the month.

In the interim, Gasprom filled the Nord Stream 2 pipe, tantalising Europe with a ready supply of gas. NS2 is still awaiting EU approval.

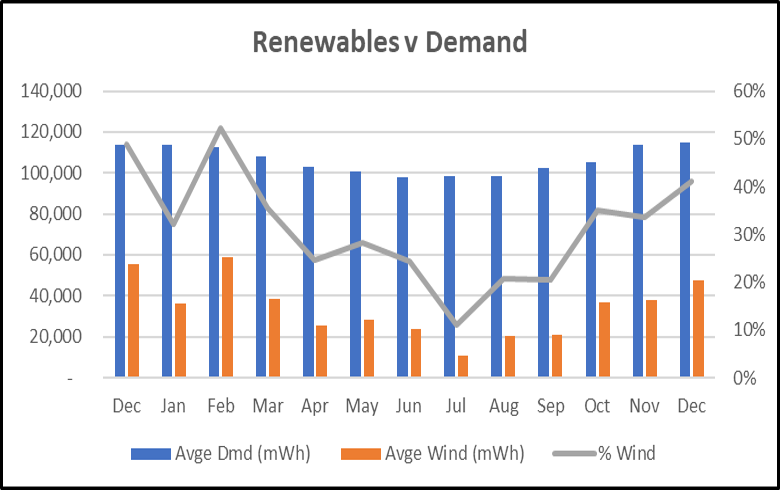

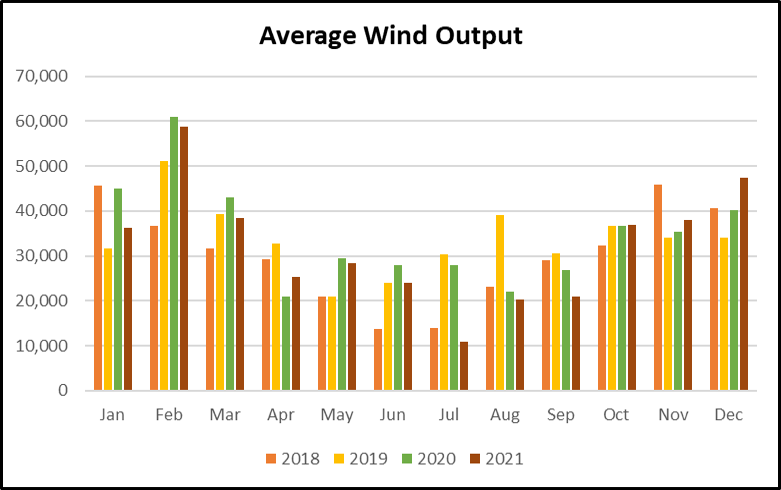

Renewables took up some of the slack

Wind generation contributed 41% of the generation mix, up 20% on November. The latter half of December had the higher renewable generation mix.

Renewable generation has improved in recent months, but 2021 will be remembered as a disappointing renewable year

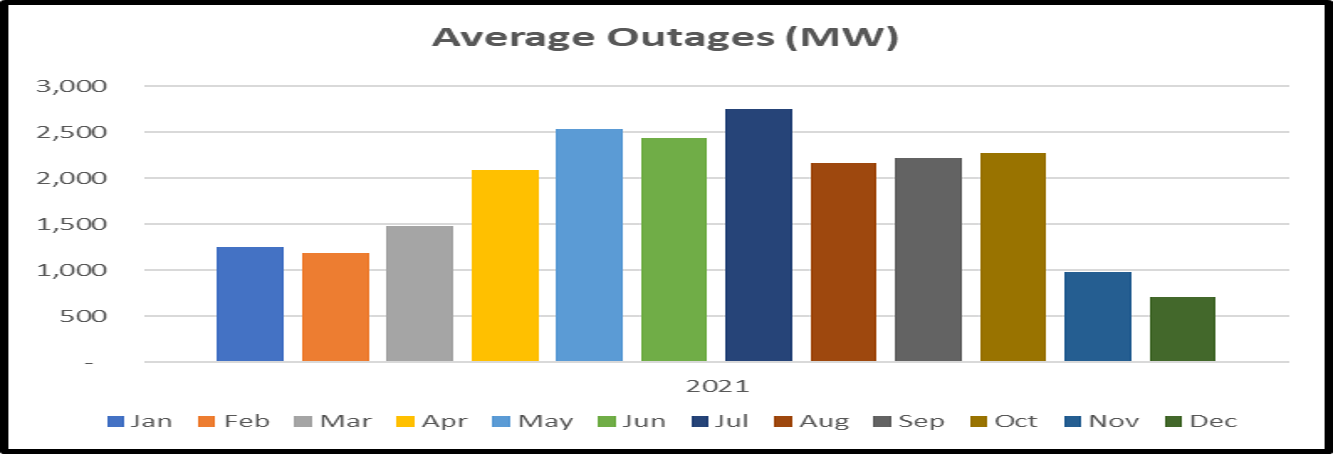

Outage worries reducing

Outages are well improved from the mid year highs. Outages averaged approx. 700MW during the month.

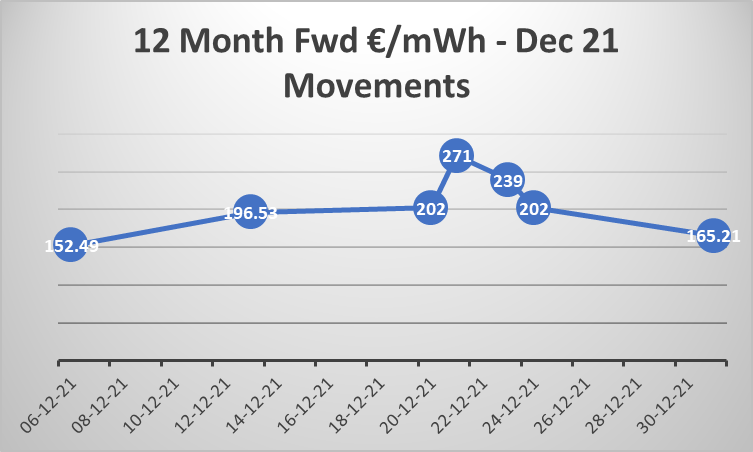

What does 2022 have in store?

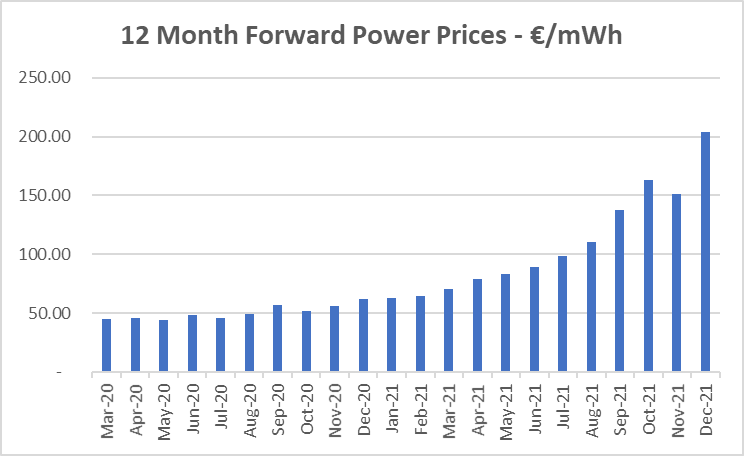

Due to volatile gas movements, 12 month forward prices varied considerably within the month, peaking at €271/mwh, falling to €165/mwh by month end.

Elevated pricing will remain while market has little clarity on Gazprom’s delivery intentions westwards.

Gas storage remains at historical lows across Europe. Gas remains the key driver of forward curves.

Disclaimer

The contents of this report are provided solely as an information guide. The report is presented to you “as is” and may or may not be correct, current, accurate or complete. While every effort is made in preparing material for publication no responsibility is accepted by or on behalf of New Measured Power Limited t/a Pinergy for any errors, omissions or misleading statements within this report. No representation or warranty, express or implied, is made or liability accepted in relation to the accuracy or completeness of the information contained in this report. New Measured Power Limited t/a Pinergy reserves the right at any time to revise, amend, alter or delete the information provided in this report.