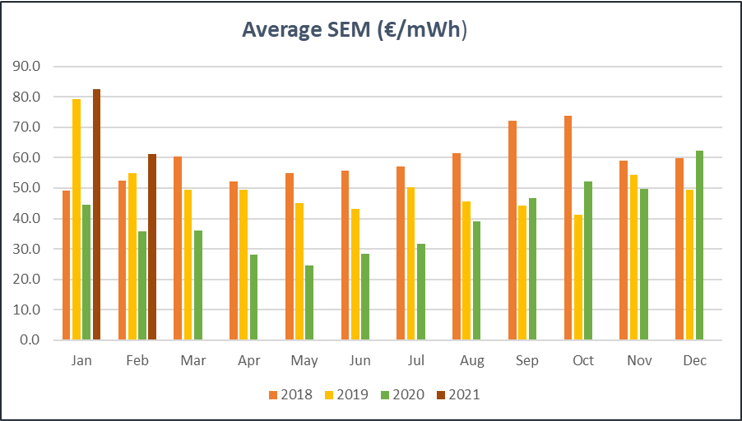

Energy Markets: A little lower, but remain much higher

Average power prices eased in February, reducing by 26% from multi-year high in January. However in February, they were €61.30 per mWh up 72% on the same period in 2020.

Specifically, the outturn in February arose for the following reasons:

- Gas prices decreased from early 50’sp/th in early Feb to low 40’s p/th in the latter half of the month, primarily due to lower demand as a result of milder weather.

- Liquefied Natural Gas (LNG) deliveries reversed the trend of previous months and were up 40% on January deliveries, reducing gas spot prices.

- Wind generation contributed 52% of the generation mix, up 62% on January’s contribution.

- Unscheduled Outages remain at some key Combined Cycle Gas Turbine (CCGT) generation plants (e.g. Whitegate 400MW) while others (e.g. Hunstown 400MW) were announced during February.

Key indicators remain elevated

A better month for the fossils

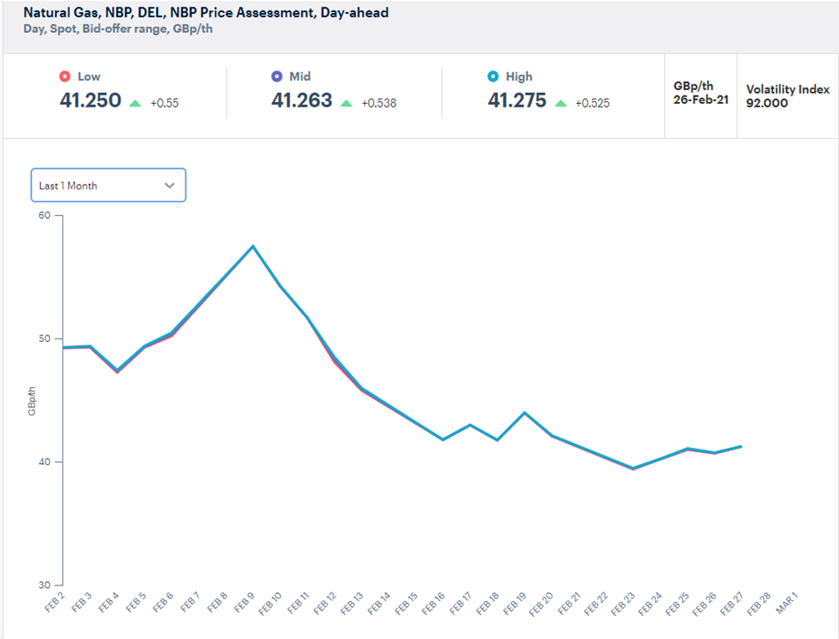

Day ahead Gas prices decreased by 20% on January levels, due to:

- Seasonal norm or better temperatures that were recorded for much of February

- LNG deliveries were up 40% on January due to tightening of the spread between European and Asian prices motivating ships to dock in Europe.

Carbon prices traded in the €37-€40/tonne range throughout February due to demand caused by thermal power and heat generation. In addition, holdings of carbon among investment funds continued to rise in February providing support to prices.

Outlook remains bullish

Power markets will remain bullish in the 1st half of 2021.

Why?

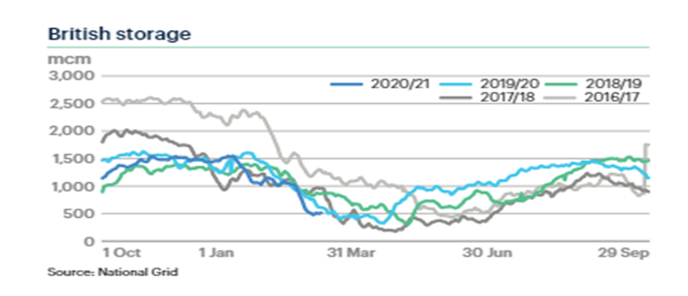

- On going support for gas prices as gas storage levels in Europe are only 20% full as at end February, 27% below 2020 levels.

Continued outages in Irish and UK power stations together with strong demand will exacerbate price increases. Carbon prices are supported by increased commercial activity after COVID-19 and ongoing speculation.

Disclaimer.

The contents of this report are provided solely as an information guide. The report is presented to you “as is” and may or may not be correct, current, accurate or complete.

While every effort is made in preparing material for publication no responsibility is accepted by or on behalf of New Measured Power Limited t/a Pinergy for any errors, omissions or misleading statements within this report.

No representation or warranty, express or implied, is made or liability accepted in relation to the accuracy or completeness of the information contained in this report. New Measured Power Limited t/a Pinergy reserves the right at any time to revise, amend, alter or delete the information provided in this report.