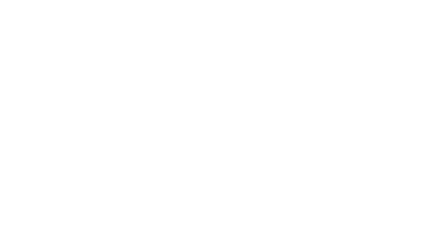

Average power in April retreated from the historical March high. Prices dropped by 25% on March.

Prices decreased as markets became accustomed to changing fundamentals of the gas market.

Gas was bearish in April

- Gas prices were bearish throughout April, but rapidly descended from mid April onwards.

Markets have calmed somewhat since then for the following reasons:

- Fundamentals of gas market have not changed: Gazprom’s YTD production up 1% on same period in 2021. Market now accustomed to lack of clarity on Gazprom deliveries.

- Liquid Natural Gas (LNG) continued it’s record breaking delivery schedule in April, breaching the record in January.

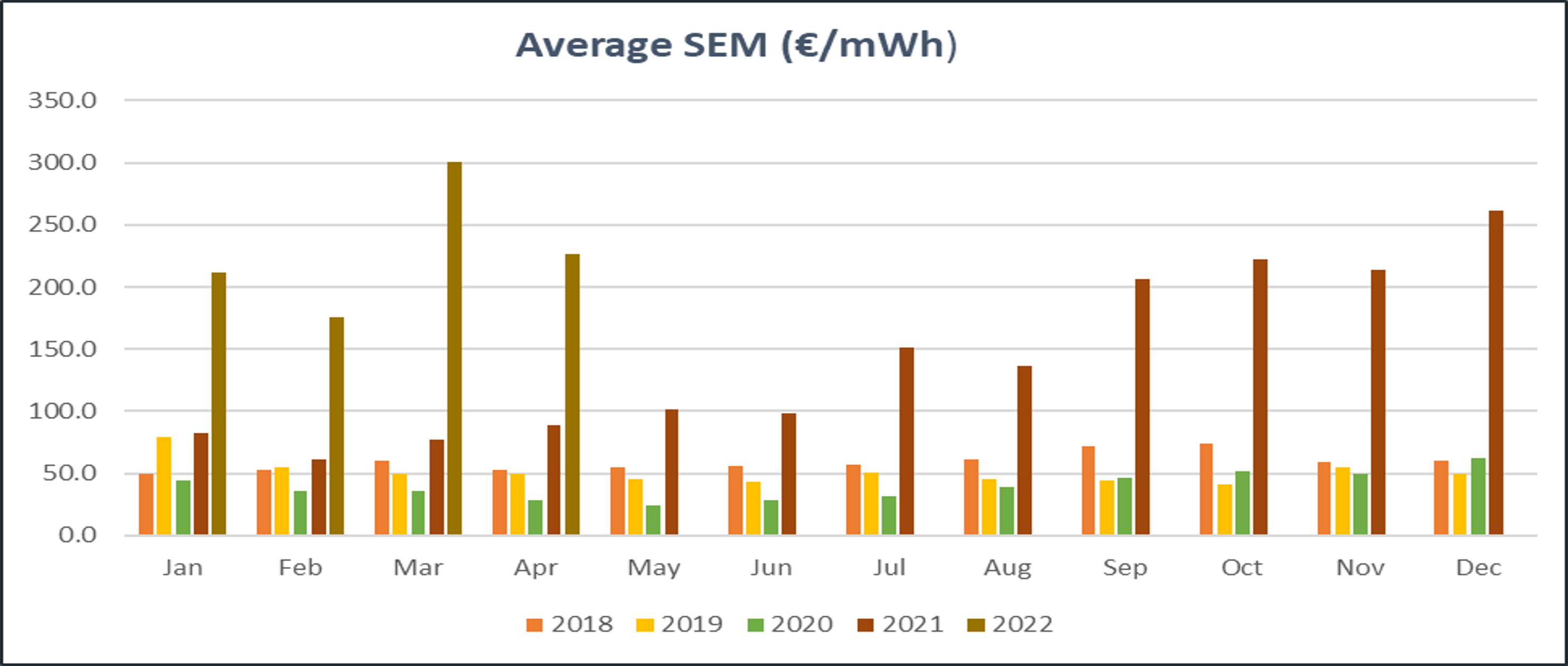

- LNG and mild weather continued to help the European storage situation, bringing storage within historic averages.

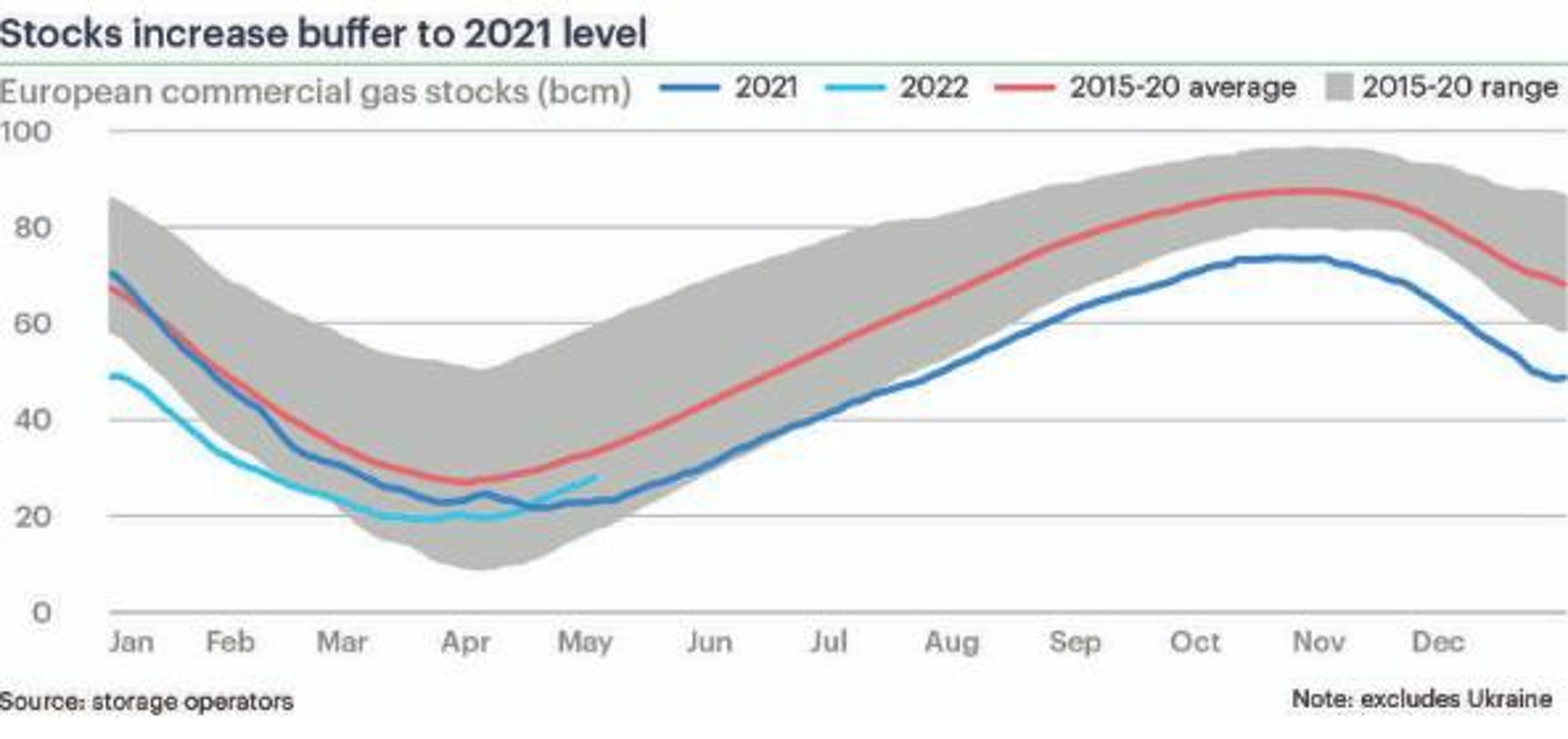

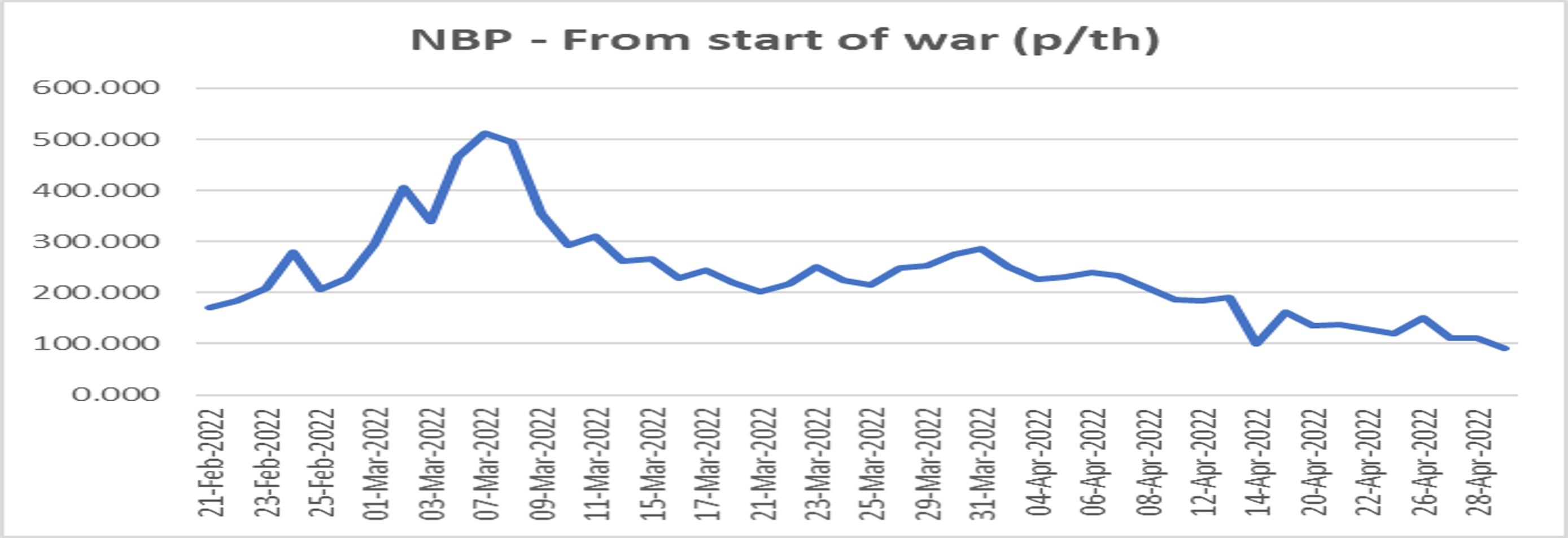

- Gas prices very volatile since war began.

- Initial spike, calm as deliveries Westward continued, spike to 500p/th, dropped again on peace talk hopes, rose to 300p/th on standoff over payments in Rubles.

- Markets have fallen since as Ruble standoff was by and large bluff and not expected until mid May at least.

- Market caught unawares by Bulgaria and Poland cut off – but has shrugged it off – SO FAR.

- EU/US announced 15bcm (increasing to 50 bcm) LNG deliveries to Europe, as Europe weans off Russian gas.

- Centralised EU procurement of gas commencing.

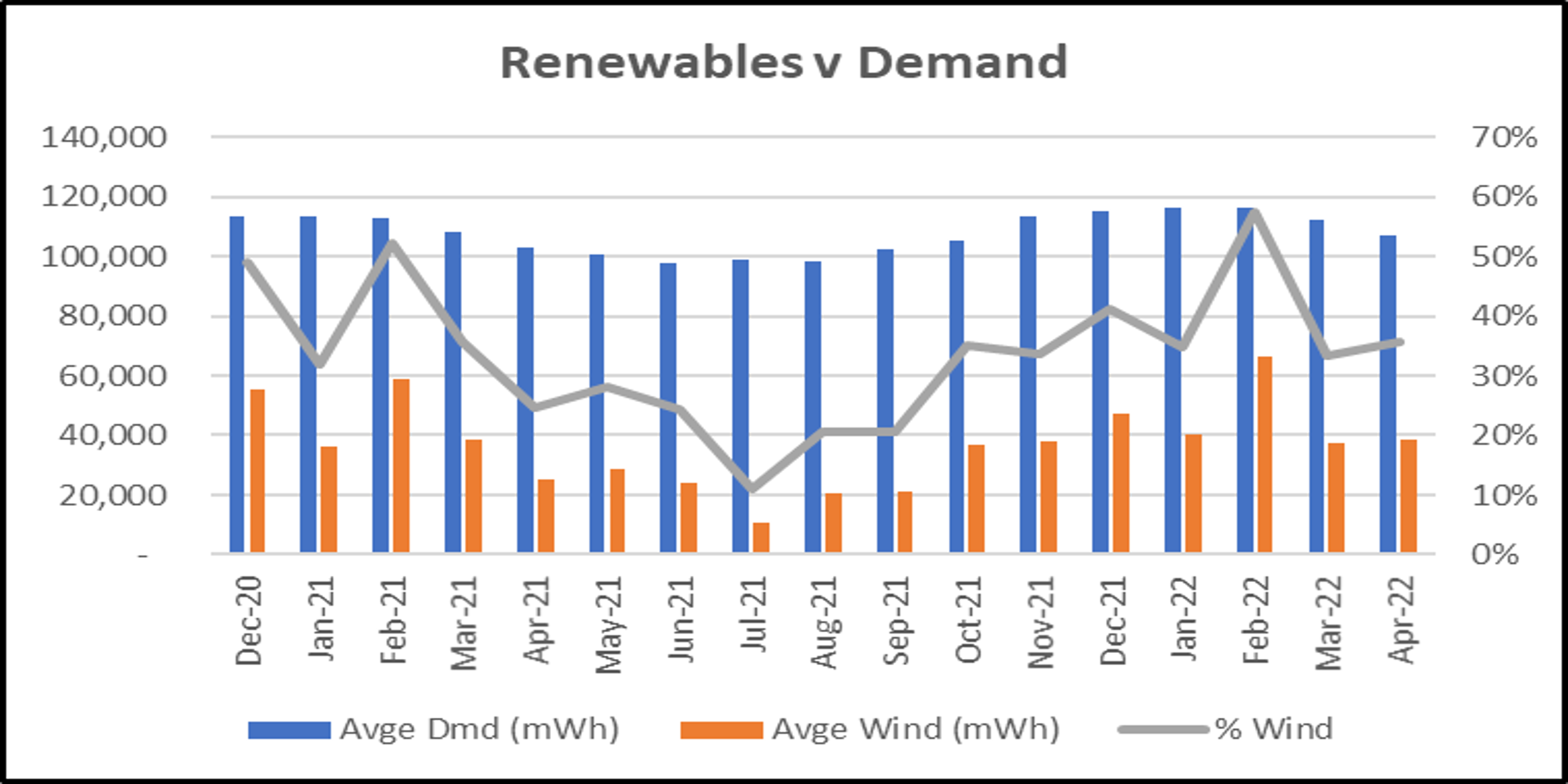

Renewables in line with March

- April was similar to March with renewables contributing just over 1/3 of the generation Mix.

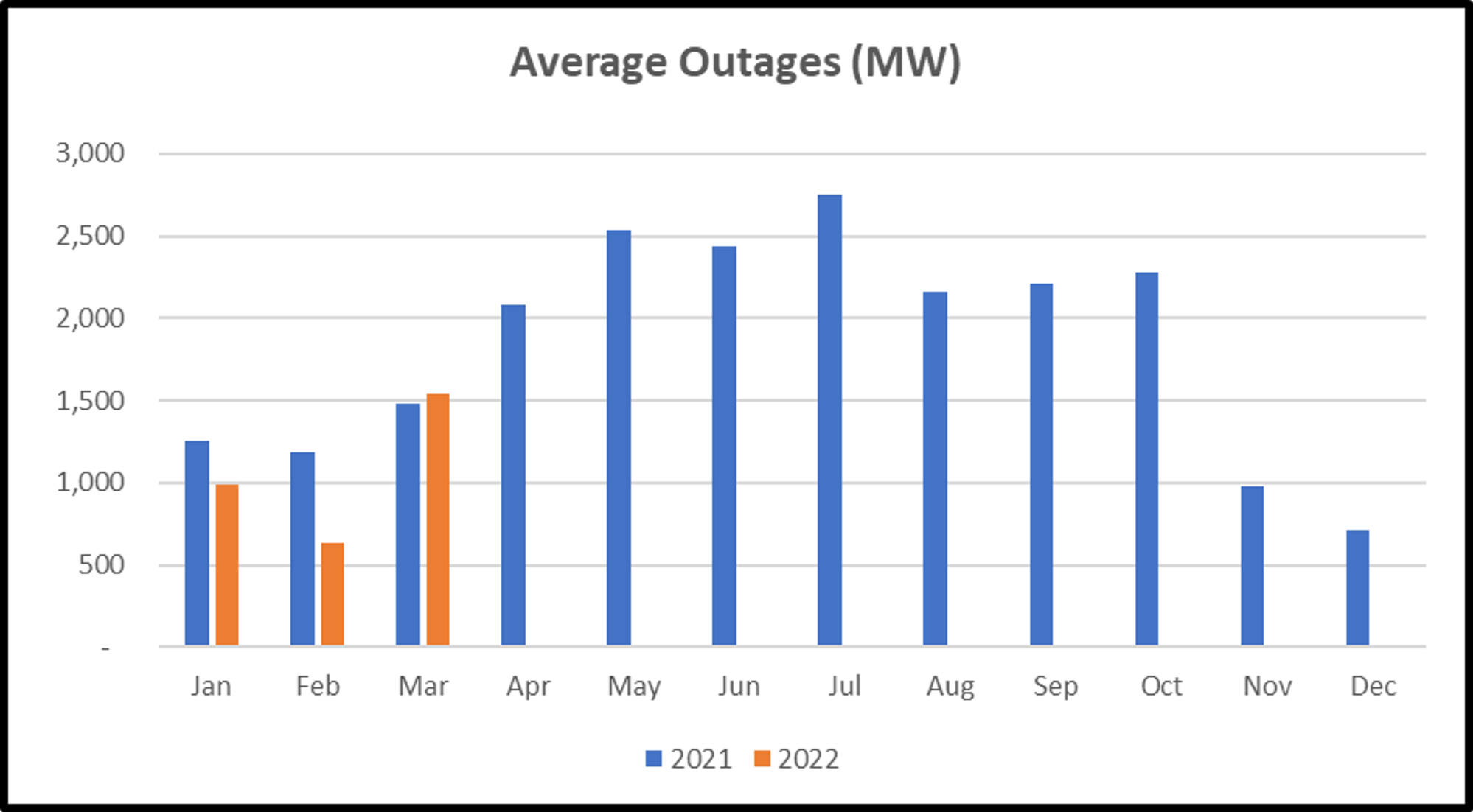

Outages in Irish power plants increased slightly

- Outages have increased on Jan and Feb lows, but continue at a reasonable level.

- Hopefully, 2021 Capacity Crisis will be averted

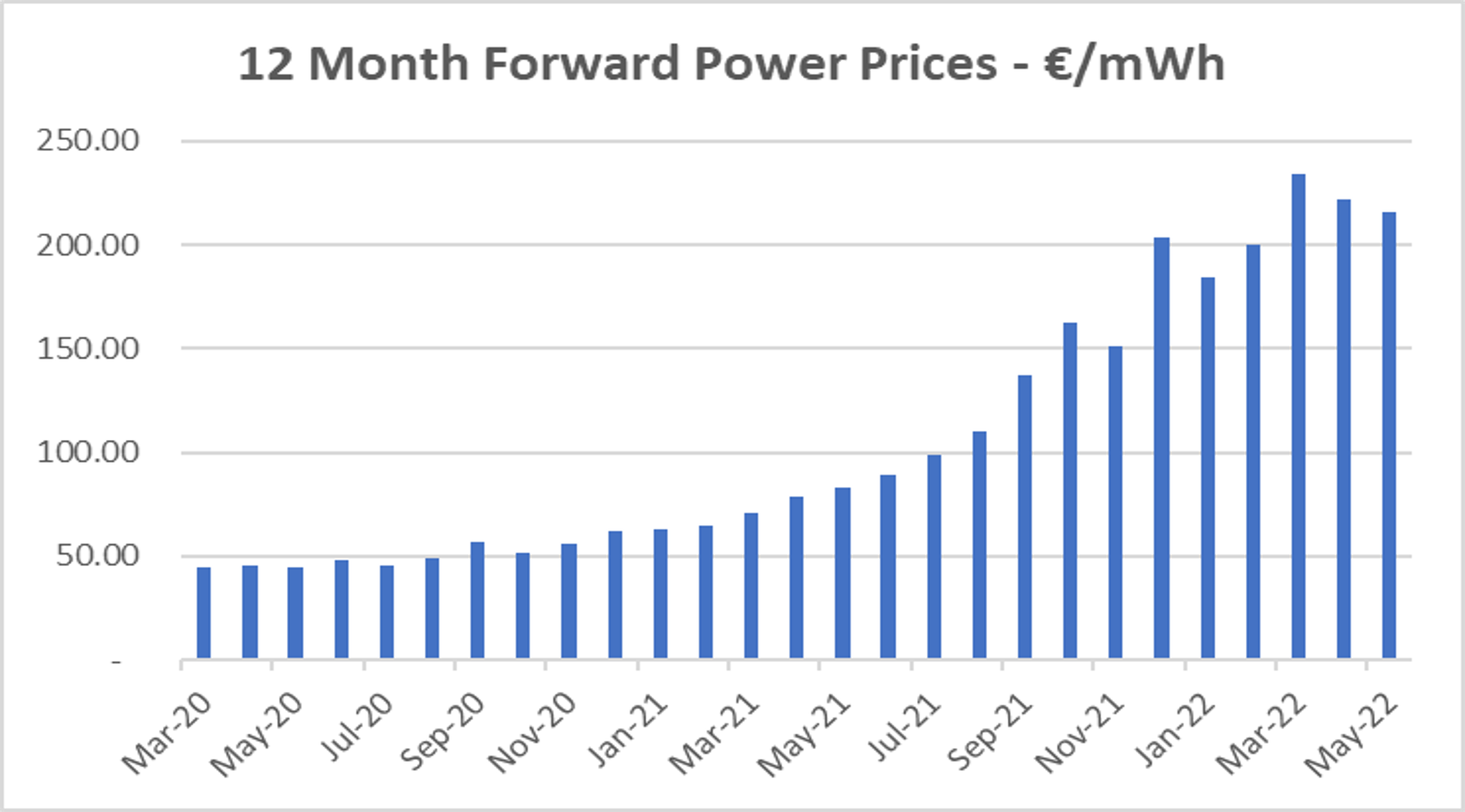

What’s ahead for the next 12 months?

- Power Forward prices coming off March high as markets get more certainty on commodities.

- The breakout of war, European sanctions and markets fear of further sanctions against Russian energy exports has increased the risk premium in forward pricing.

- That premium will remain while the uncertainty of the Ukrainian situation remains.

Key drivers for forecasting

- Geopolitical situation in Ukraine – Negative

- Weather – Mild winter – Storage hasn’t been depleted as feared – Positive

- Pent up demand for and EU Mandated storage levels will impact Gas Summer refilling season – will support prices – Negative

- LNG deliveries will remain strong – US key source – Positive

- Moral and Political demand for sanctions on gas and oil – Negative

Disclaimer

The contents of this report are provided solely as an information guide. The report is presented to you “as is” and may or may not be correct, current, accurate or complete. While every effort is made in preparing material for publication no responsibility is accepted by or on behalf of New Measured Power Limited t/a Pinergy for any errors, omissions or misleading statements within this report. No representation or warranty, express or implied, is made or liability accepted in relation to the accuracy or completeness of the information contained in this report. New Measured Power Limited t/a Pinergy reserves the right at any time to revise, amend, alter or delete the information provided in this report.