Energy Markets Insights: US LNG becomes manna from heaven

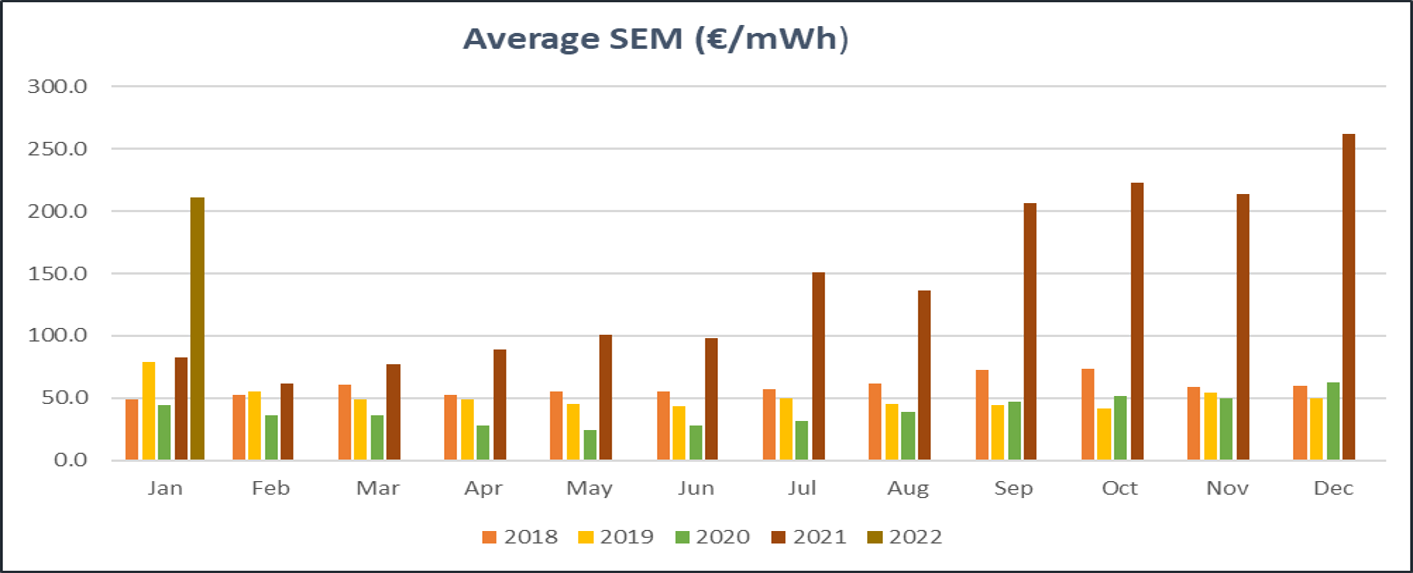

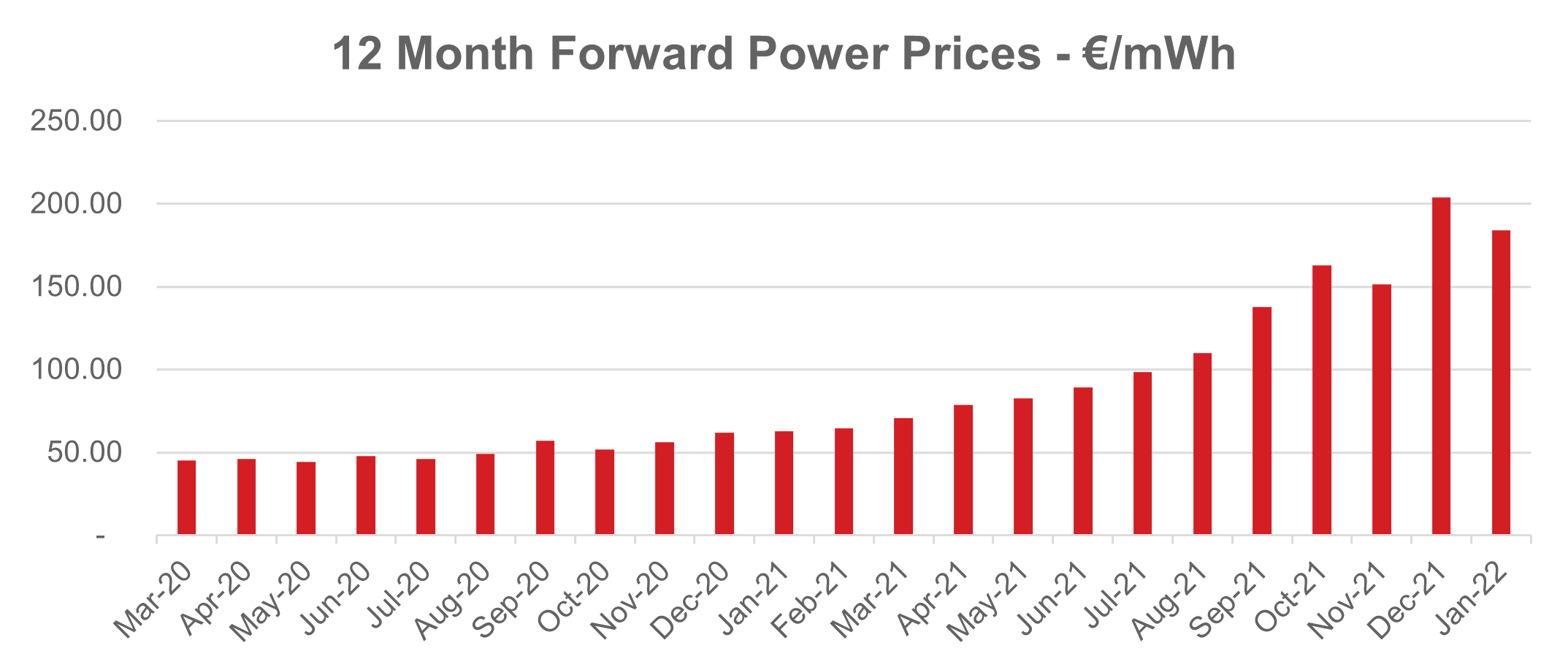

Average power decreased in January down 23% on December, coming in at €211/mWh, 150% up on the same period in 2021.

The energy crisis is still raging, unabated.

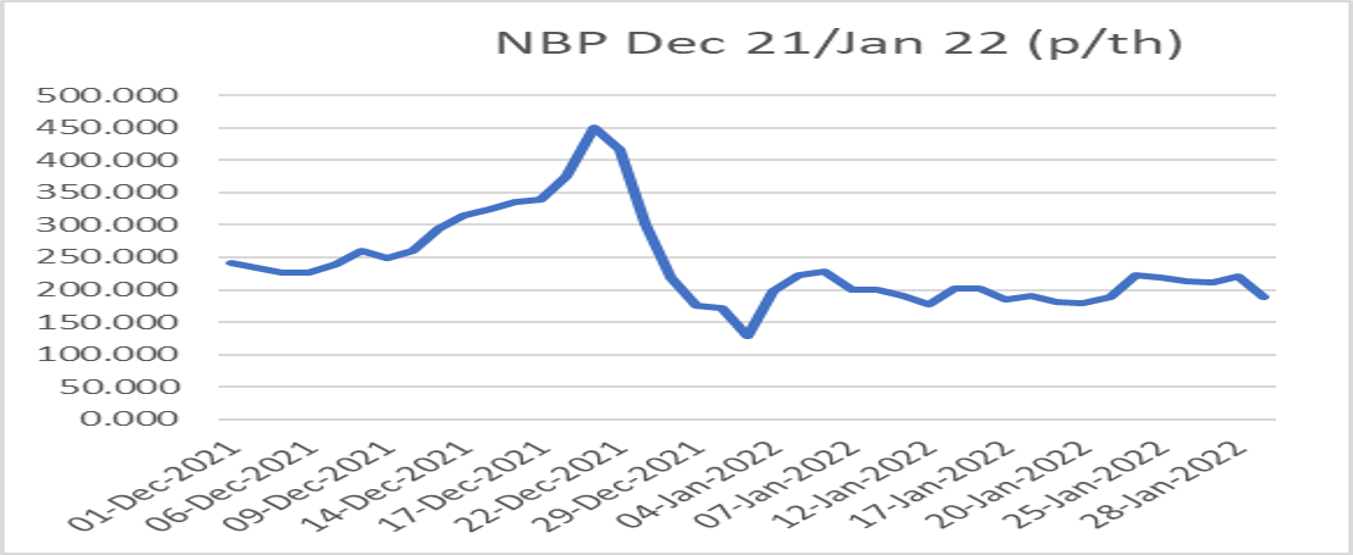

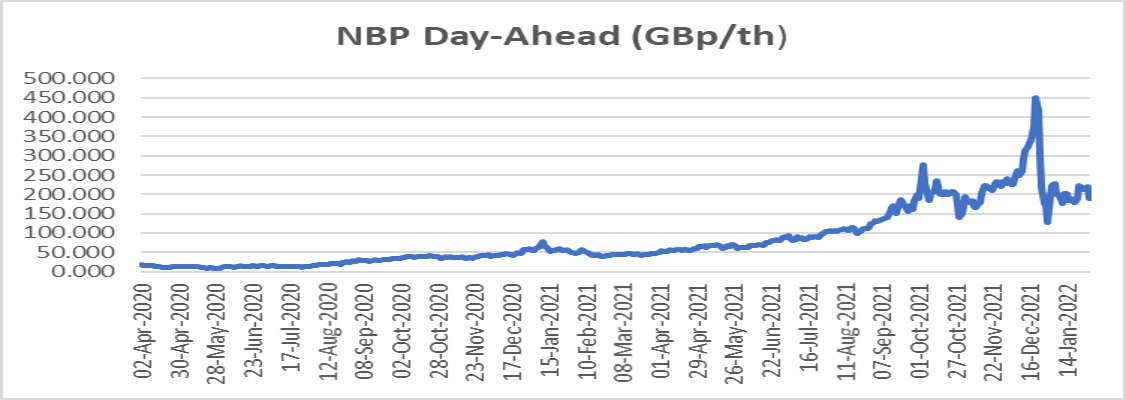

1. Gas prices stabilised in January helped by US LNG imports to Europe

- Relatively stable gas prices in January helped the lower outturn for power in January.

- Geopolitical risk has supported price at/or over 200p/th.

- Market has priced in lack of direction of Gazprom deliveries. Gas moved Eastwards throughout January at Malnow (German /Polish border).

- The flotilla of Liquid Natural Gas (LNG) deliveries to Europe that commenced after the price spike in late December have continued.

- Record LNG imported to Europe in Jan ‘22. 3x on Jan 21 levels. 18% increased on previous record.

- Over 50% of Jan ‘22 deliveries sourced from US.

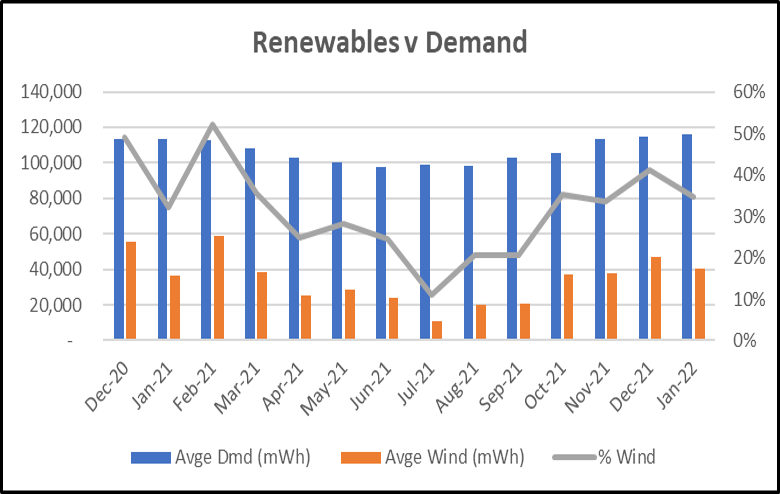

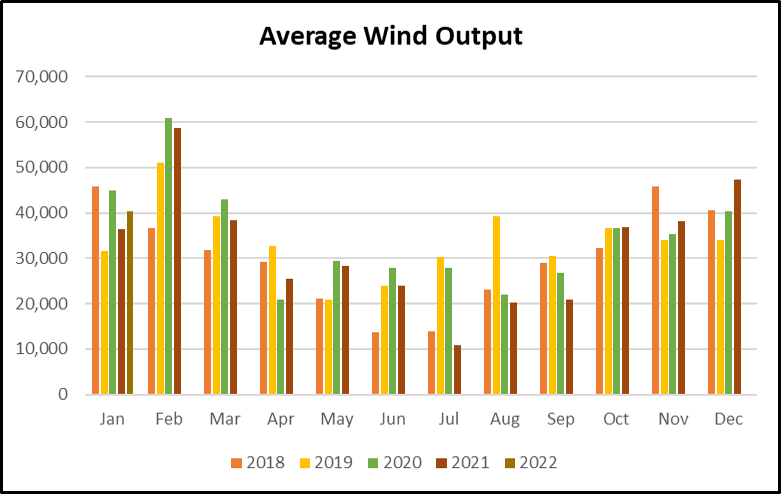

2. Renewables continued to improve boosted by more Wind

- Wind generation contributed 35% of the generation mix, down 20% on December.

- Renewable generation has improved in recent months, but 2021 will be remembered as a disappointing renewable year.

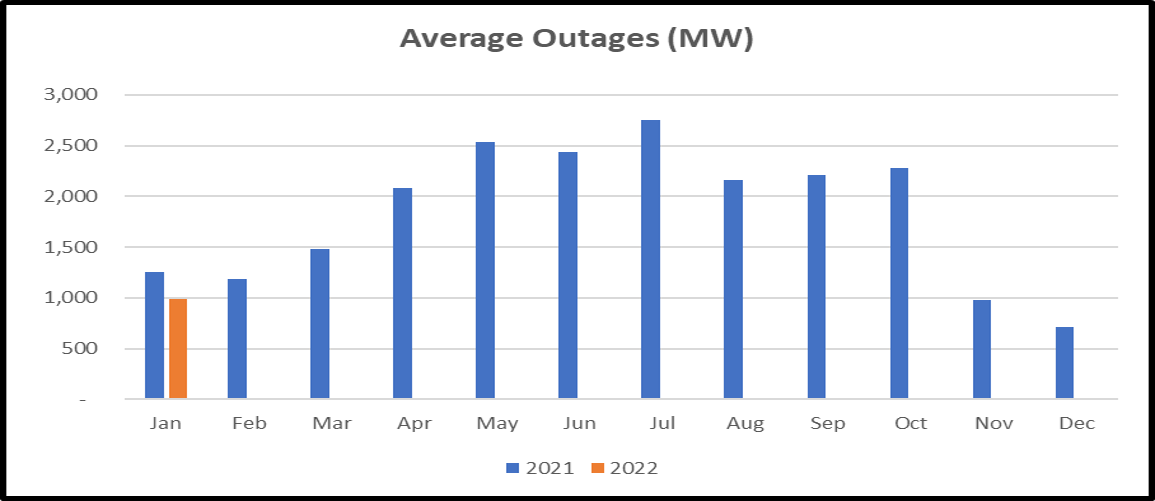

3. Irish Outages have improved since Summer of 2021

- Outages are well improved from the mid 2021 highs. Outages averaged 985MW during the month. The main outages were early in the month when demand was lower

What’s next?

- Forward price of power remains elevated due to bullish gas prices.

- Gas price supported by geopolitical uncertainty and failure by Gazprom to increase flows Westwards.

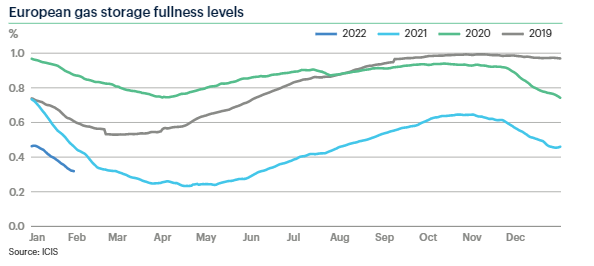

- European storage situation continues to deplete. 36% full as at end January. 20 points below 2018-21 average

- Storage reached 10% full following Beast from East

- With high summer ‘22 gas prices high, little incentive for shippers to buy ahead for storage.

- Poor visibility on Gazprom’s delivery intentions westwards.

Key drivers to watch

- Geopolitical situation in Ukraine – Negative

- Weather – Mild winter – February forecasts indicating above normal temperatures – Positive (so far)

- Pent up demand for Gas Summer refilling season – will support prices – Negative

- LNG deliveries will remain strong – US key source – Positive

Disclaimer

The contents of this report are provided solely as an information guide. The report is presented to you “as is” and may or may not be correct, current, accurate or complete. While every effort is made in preparing material for publication no responsibility is accepted by or on behalf of New Measured Power Limited t/a Pinergy for any errors, omissions or misleading statements within this report. No representation or warranty, express or implied, is made or liability accepted in relation to the accuracy or completeness of the information contained in this report. New Measured Power Limited t/a Pinergy reserves the right at any time to revise, amend, alter or delete the information provided in this report.