Energy Markets: The rollercoaster continues

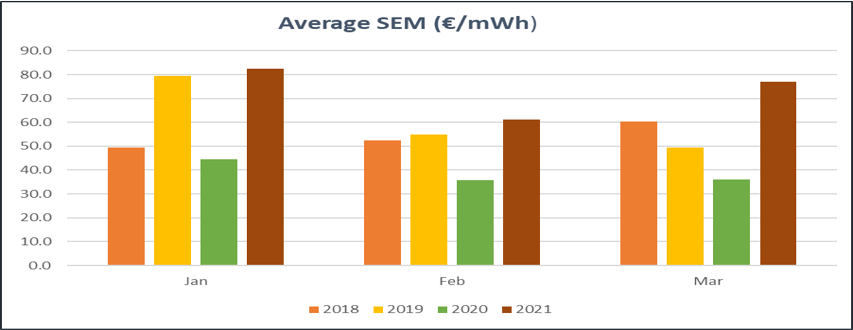

Average power prices soared in March (following a dip in February) increasing by 25%.

In March 2021, they were €77.10 per mWh, up a whopping 113% on the same period in 2020.

Specifically, the outturn in March arose for the following reasons:

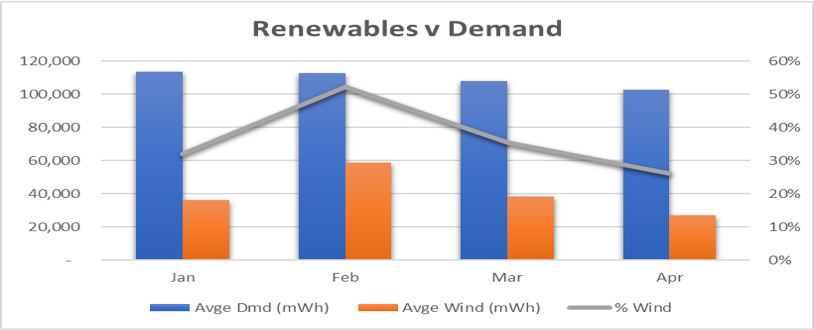

- Wind generation contributed only 36% of the generation mix, down 30% on February’s contribution.

- Unscheduled Outages remain at some key CCGT generation plants (e.g. Whitegate 440MW, Huntstown 400MW), while overall outages averaged approximately 1,500MW

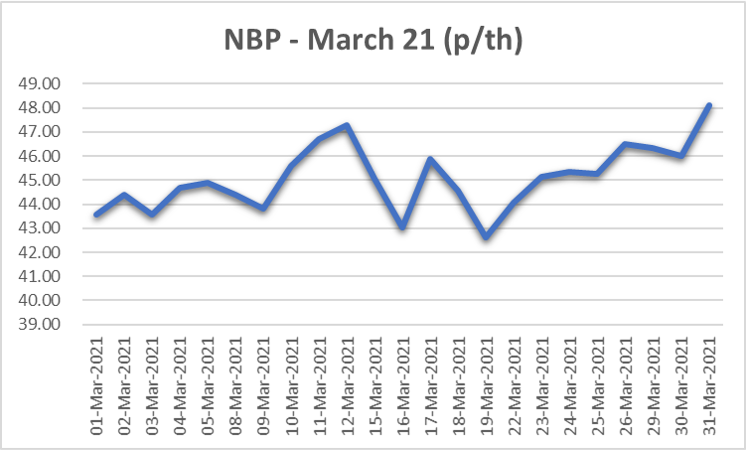

- Gas prices averaged 45p/th (similar to February) although prices rose 10% from early March to late March, primarily due to higher demand as a result of colder weather.

- Assisting the stabilisation of gas prices, was continued LNG deliveries, well up on previous months.

Key Performance Indicators remain elevated

The Q1 Single Electricity Market (SEM) Pricing continues to be elevated compared to recent years.

Proportion of Renewables in generation mix is low versus February

Gas prices (a key indicator of energy prices) continued to creep up during March finishing 10% higher than the beginning of the month.

Gas Prices continued to increase

Day ahead Gas prices were similar to February, but increased 10% from start to end March due to:

- Cooler weather increased demand and further depleted storage to less than 24% full storage.

- LNG deliveries continued their upward trend helping cap gas price increases

Carbon prices traded above €40/tonne throughout March due to demand caused by thermal power and heat generation. In addition, holdings of carbon among investment funds continued to rise in March providing support to prices.

What’s the outlook?

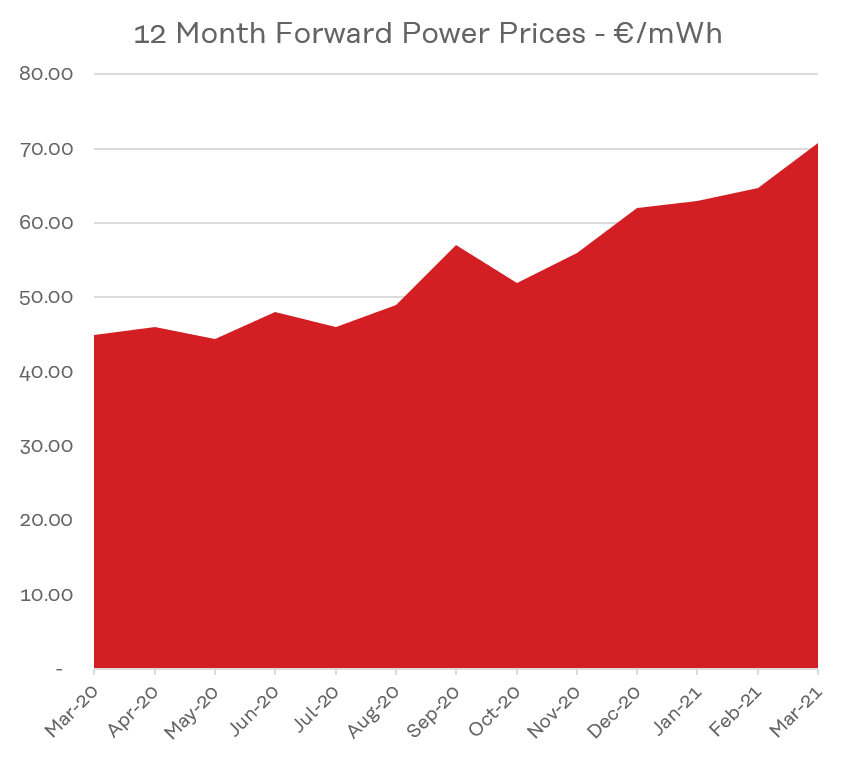

Forward energy prices indicate Power markets will remain elevated throughout 2021, with little relief in Q2 and Q3 due to;

- On going support for gas prices as gas storage levels in Europe are only 24% full compared to 51% full a year earlier.

- Significantly, continued outages in key Irish power stations are expected to continue throughout 2021.

- Carbon prices are supported by increased commercial activity after COVID-19 and speculation.