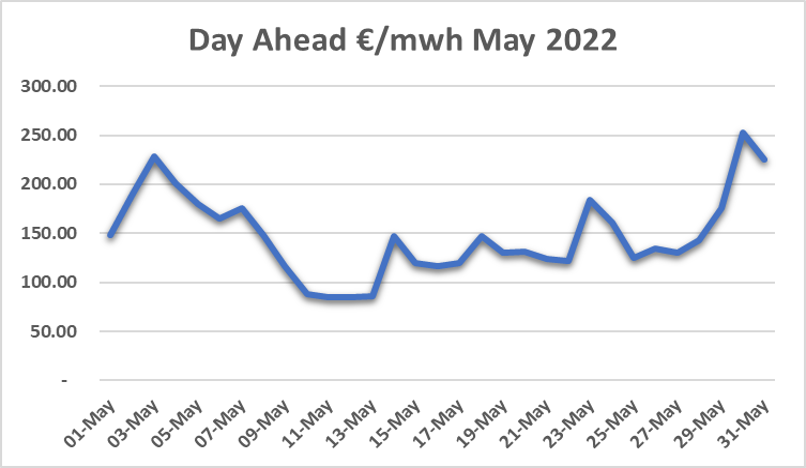

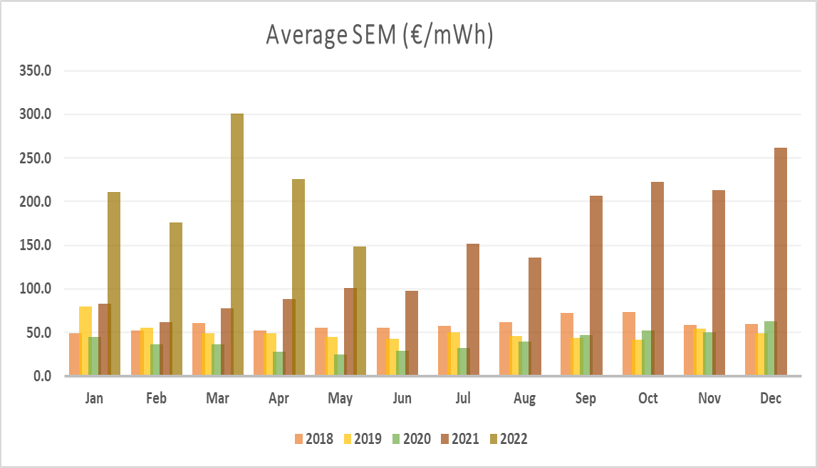

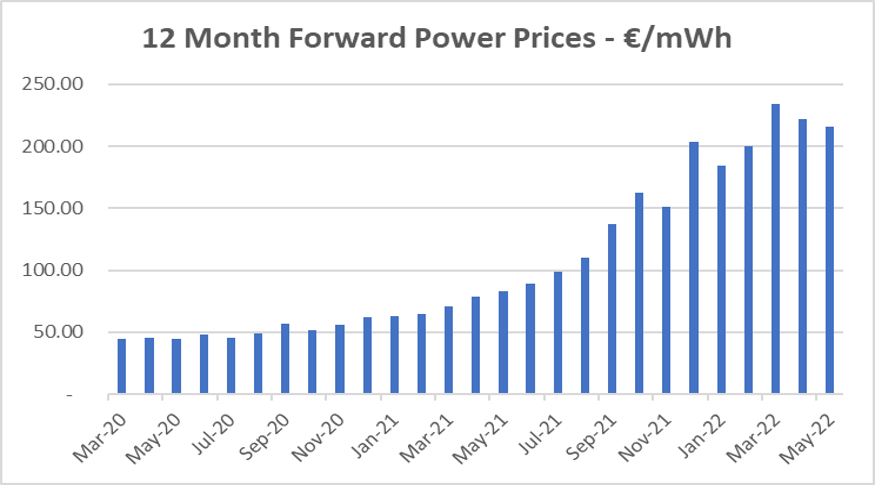

Average power in May continued the downward trend seen in April. Prices dropped by 35% on April with May’s outturn being €148/mwh compared to €226 in April.

It was a tale of two halves however.

Daily prices decreased in the first half of the month, to levels briefly seen in early January and then saw a surge in the later half of the month.

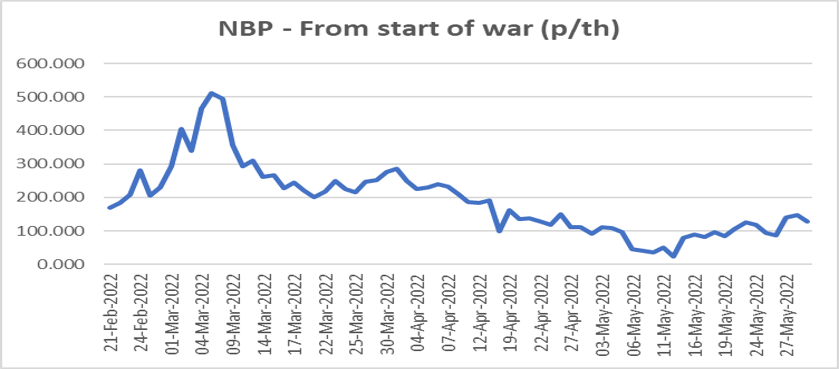

1. Impacts of the Ruble decree on Gas

- Gas prices were bearish in the first half of the month, due to mild weather, improving gas storage and decent wind output reducing the need for gas generation.

- However, gas prices gained in the latter half of the month as the impact of President Putin Ruble payment decree began to manifest.

- Gazprom ceased deliveries to Finland, key Dutch trader GasTerra, Orsted in Denmark and Shell Germany as each party refused to comply with the Ruble payment decree. This decision spooked markets increasing the risk premium for gas.

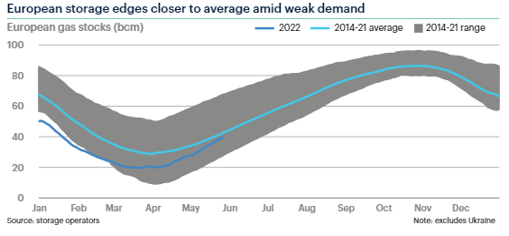

- Liquid Natural Gas (LNG) continued to arrive in European ports in large quantities in May well above previous year averages, assisting the normalisation of European storage levels.

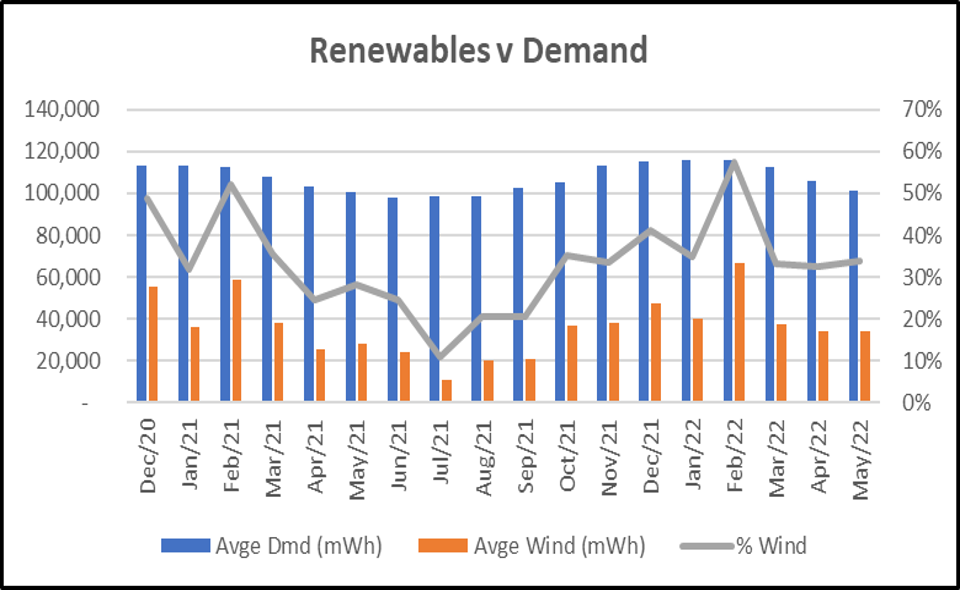

2. Renewables continue to contribute about a third of power supply

- May was a similar story to April, with renewables contributing ~34% of the generation Mix.

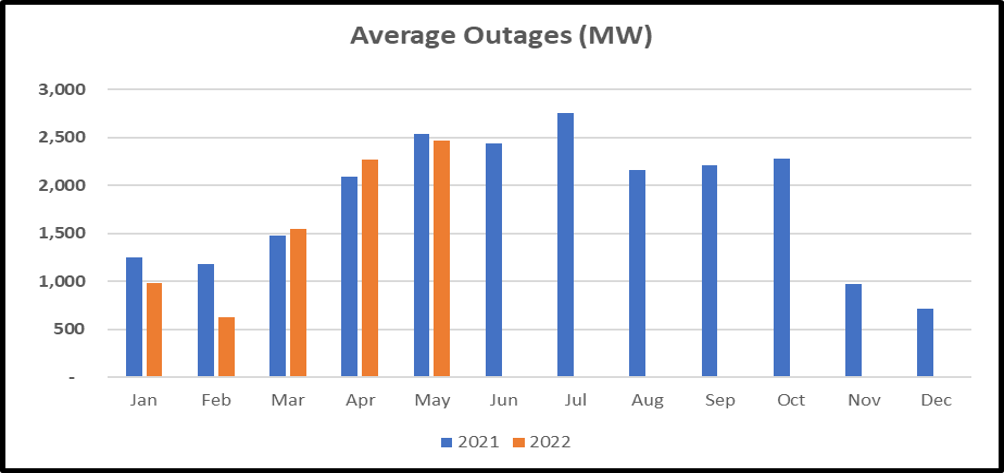

3. Generation continue at reasonable levels

- Outages have continued to increase on Jan and Feb lows, but continue at a reasonable level.

- Hopefully, 2021 Capacity Crisis will be averted, with outages staying below 2,000 MW over the summer servicing period.

What’s next?

- Power Forward prices saw a slight decrease from April.

- The breakout of war, European sanctions and markets fear of further sanctions against Russian energy exports has increased the risk premium in forward pricing.

- That premium will remain while the uncertainty of the Ukrainian situation remains.

The key drivers for the market

- Geopolitical situation in Ukraine – Negative

- EU ramp up plans for renewable energy generation projects, in order to reduce future reliance on Russian Gas supplies – Positive

- LNG deliveries will remain strong – Positive

- Weather – Mild winter & Spring has helped normalise European Storage – Positive

- Gazprom may continue to cease deliveries to large EU buyers – Negative

- Moral and Political demand for sanctions on gas and oil – Negative

Disclaimer

The contents of this report are provided solely as an information guide. The report is presented to you “as is” and may or may not be correct, current, accurate or complete. While every effort is made in preparing material for publication no responsibility is accepted by or on behalf of New Measured Power Limited t/a Pinergy for any errors, omissions or misleading statements within this report. No representation or warranty, express or implied, is made or liability accepted in relation to the accuracy or completeness of the information contained in this report. New Measured Power Limited t/a Pinergy reserves the right at any time to revise, amend, alter or delete the information provided in this report.