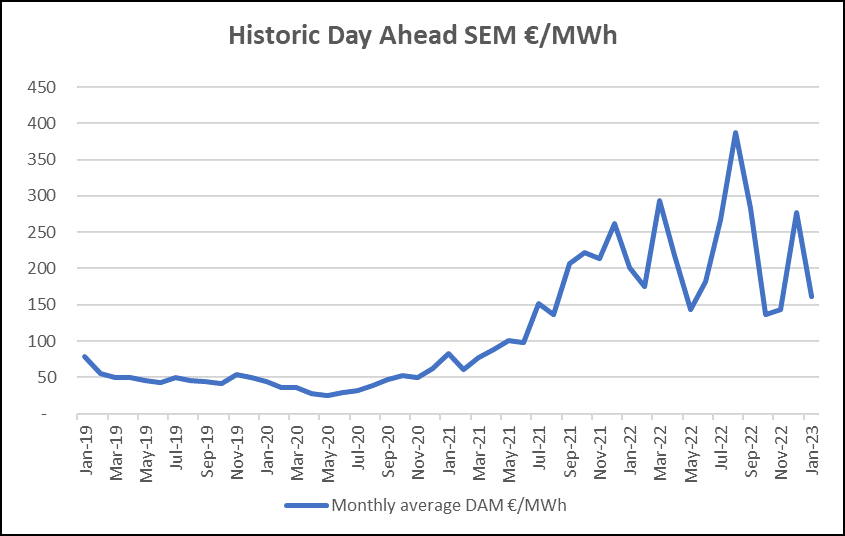

The relative calm witnessed in late December in the power markets continued into the new year.

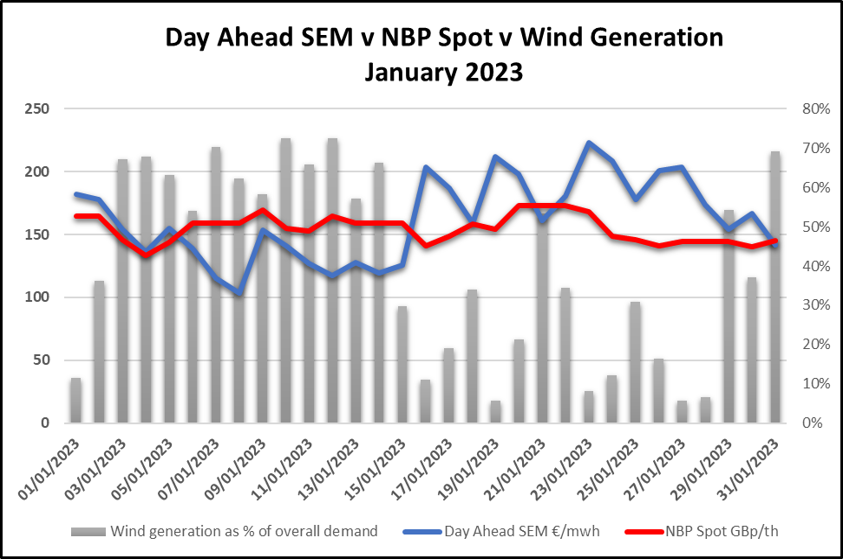

On average, prices in the SEM Day Ahead reduced by 41% month-on-month. January’s outturn was €162/MWh, compared to €277 in December.

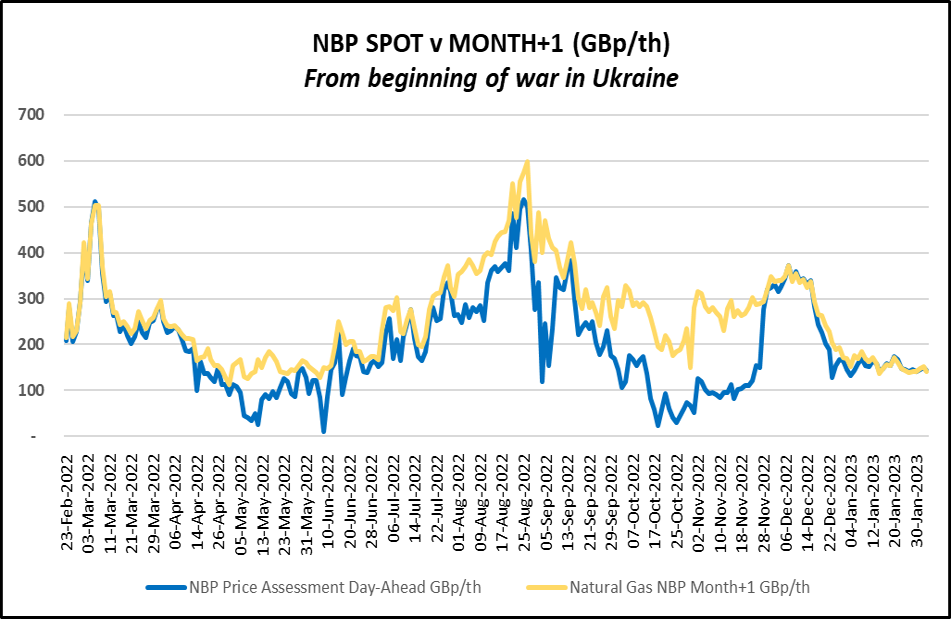

Lower prices were assisted by lower volatility in the British gas (NBP) market and much higher levels of wind, when compared with early December.

Gas – Pricing & Supply

-

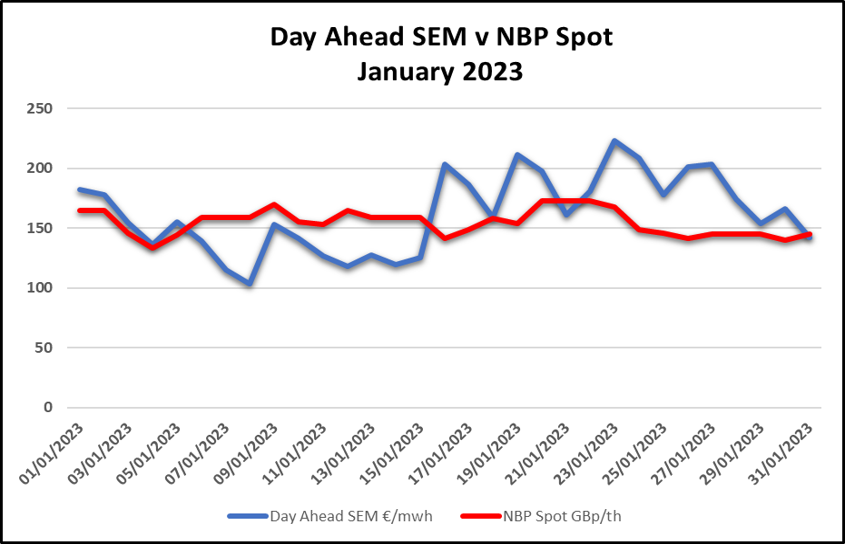

When January is viewed in the context of the last 12 months, it would appear that relative calm has set into the British gas market recently.

- There have been some daily spikes and retreats of around 10%, reminding us that volatility could rear it’s head at any time. However, any significant movements have generally evened out over the course of the month.

- The main factors behind this reduced volatility of late are:

- Warmer weather expectations for late winter and early spring.

- Continued flows of LNG.

- Comfort around aggregated storage levels in the continent.

- Reports from Freeport LNG terminal in Texas that the second largest LNG export facility in the US aims to resume exports within Q1 2023; in time for the re-filling season.

Gas – Consumption & Storage

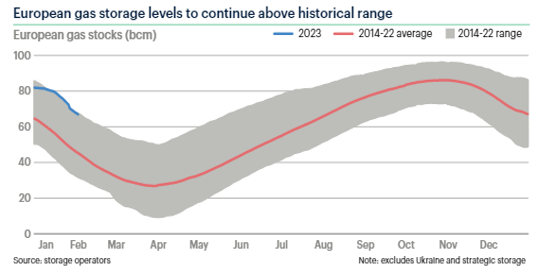

- By all reports EU aggregated storage sites appear to have stood the test of winter season. Helped of course by higher mandated levels pre winter and relatively warm average winter temperatures. See data below, obtained from ICIS.

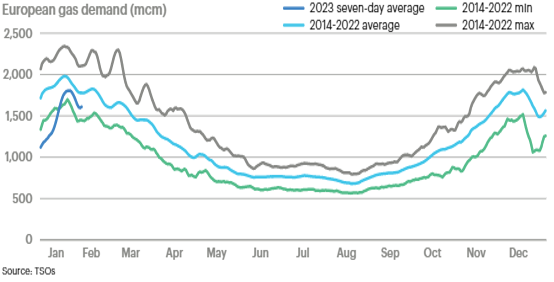

- Gas demand in Europe appears not to be exceeding any levels that might provoke stronger demand reduction measures, for now. See graph below, obtained from ICIS.

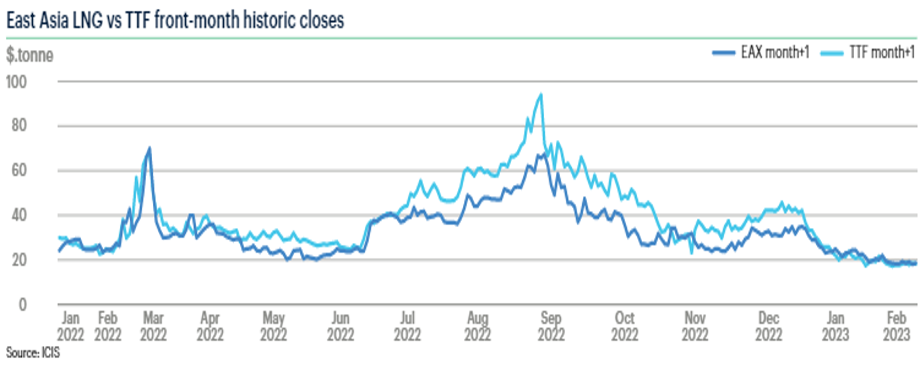

- Month ahead gas contracts in Europe (including the UK) have been trading at a premium to other key global comparative markets, ensuring that supply has remained at the level required to navigate the colder winter months.

- As the data from ICIS below shows, this premium has been bridged by the East Asian LNG month+1 contract recently. This is a key area to watch, and Europe will need to remain competitive in the global LNG markets to ensure security of supply in the future.

Renewables

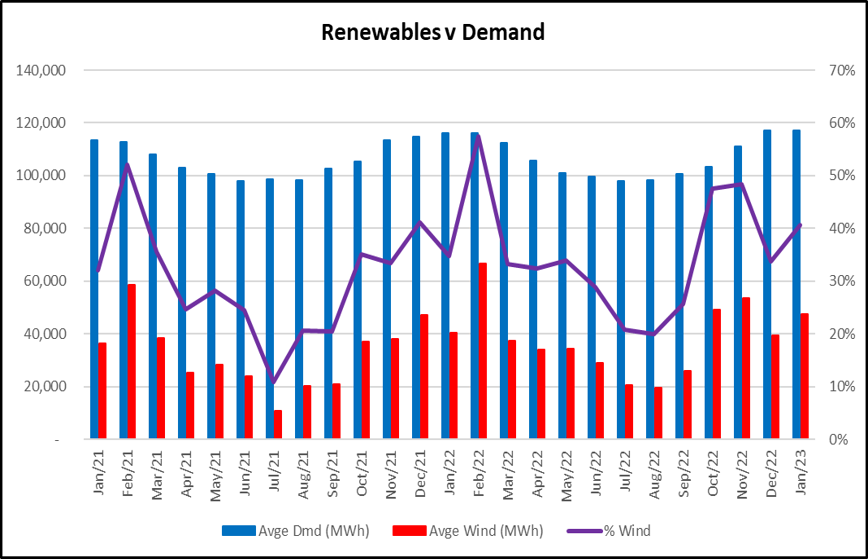

Renewables, in the form of wind, contributed 41% of the Generation Mix in January; This is high, even for January, with the same month last year producing 35%. See graph below;

High wind levels was the main driver behind lower power prices in January. The graph left showing that when wind generation was down during the month, the wholesale cost of power was generally higher, and vice versa.

Generation Capacity

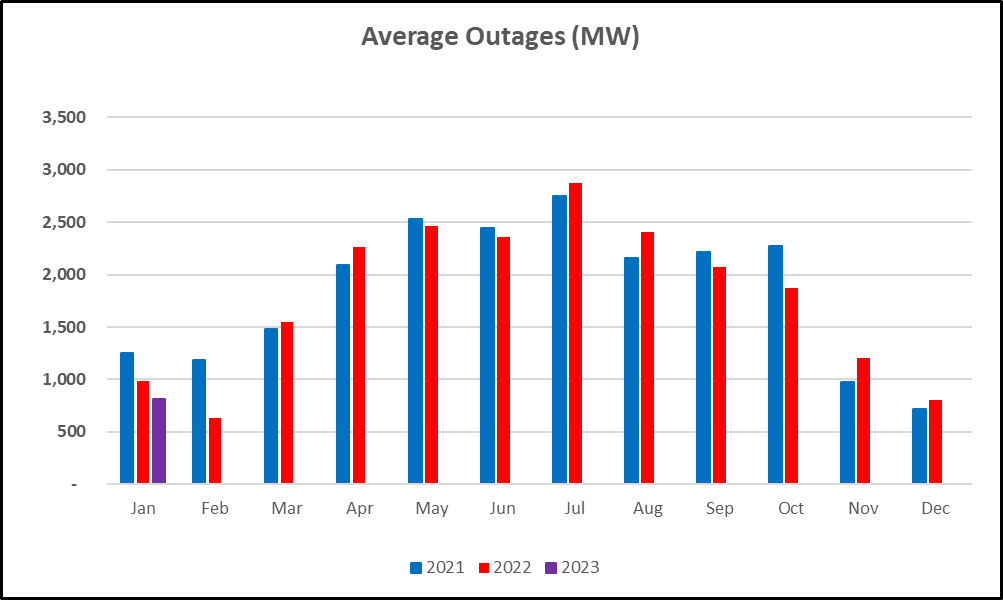

- Kudos to grid operators who maintained outages at the lowest level seen in January for the last 3 years.

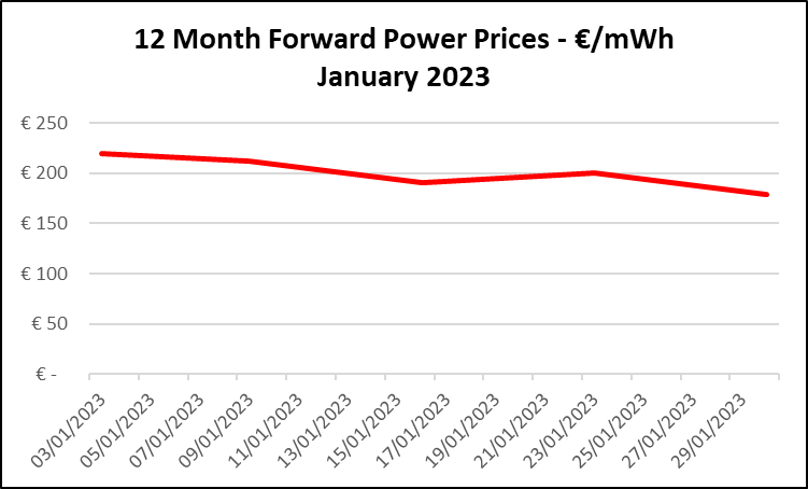

Forecasts – Power Forward Prices

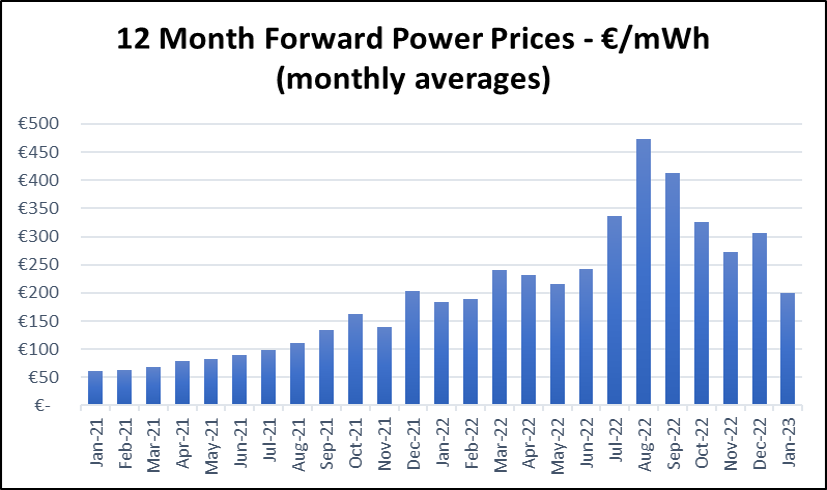

- After a spike in forward price forecasts in early December, the outlook improved significantly into January.

- Warmer than average winter/spring weather forecasts for Europe have become widely accepted and LNG has continued to flow into the EU and the UK, as the price has remained right. These two key factors have eased concerns over security of gas supply toward the end of winter and into the 2023 re-filling season.

- Tragically for the people of Ukraine, the end of the war there is not yet in sight. This, along with myriad shifting geopolitical factors, will see a high level of risk premium remain in energy markets in the short to medium term.

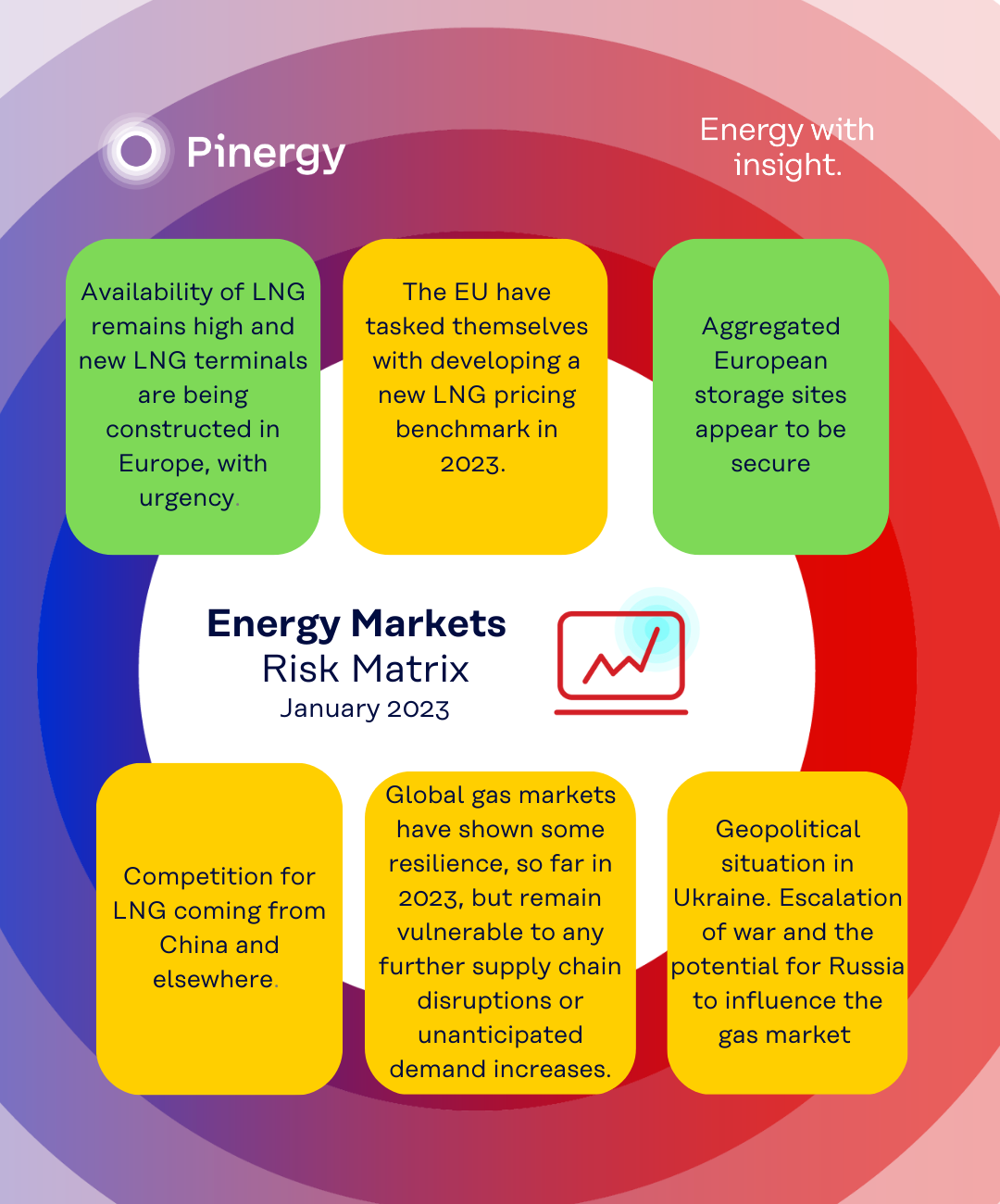

Pinergy Risk Matrix

We have compiled a list of the key factors we feel have the highest potential to influence power prices over the coming 12 months and rated as follows:

Green = Price reducing impact and highly probable.

Amber = Risk of increased power prices and of lower concern.

Red = Significant risk to 12 month forward price outlook, with medium to high probability.

With the warmer weather outlook and signs that more US LNG is on the way from Freeport Texas in Q1/Q2 2023, the risk of increasing prices has decreased since the end of 2022. However, volatility remains in both the markets and the climate and risk premiums remain elevated.