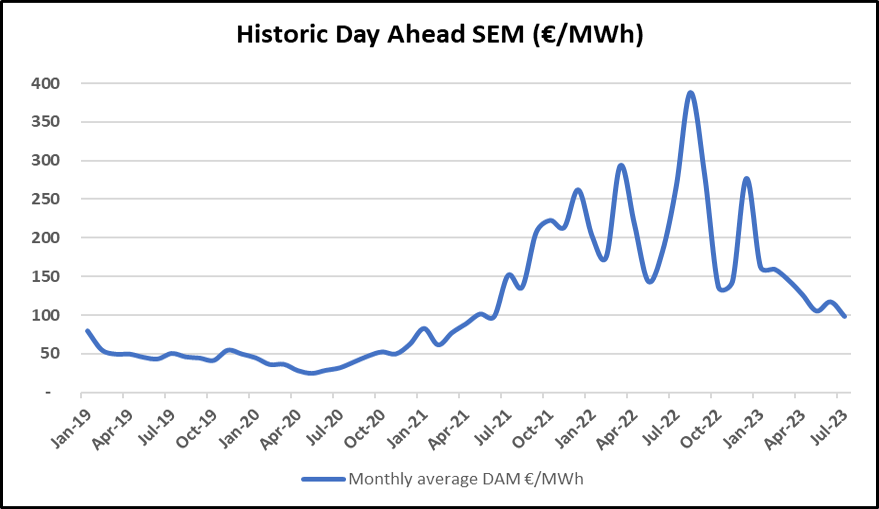

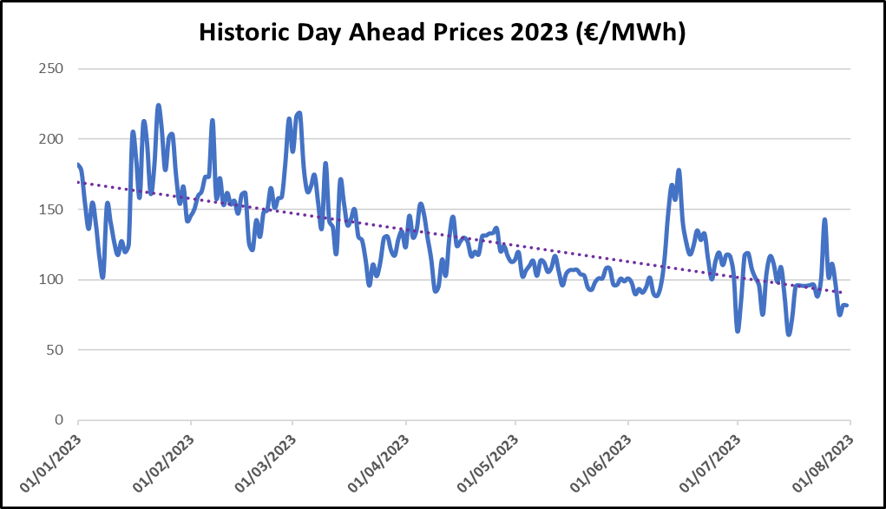

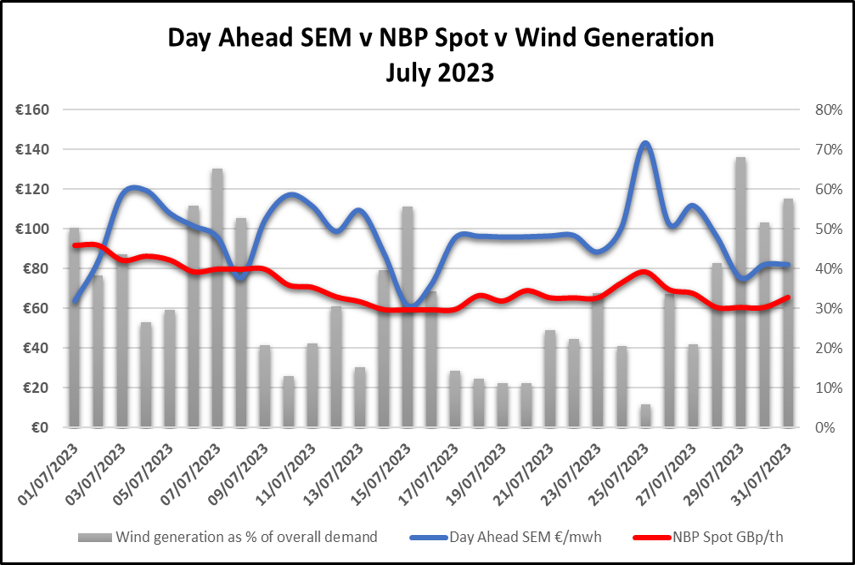

We saw a reversal in July, of the upward pressure on power prices witnessed in June. Average prices in the SEM Day Ahead decreased 18% month-on-month. July outturn was €96/MWh, compared to €117 in June. This was the lowest monthly average seen in the Day Ahead since April 2021. Un-seasonably high wind generation was responsible for some of that cost reduction in July.

Increasing levels of solar generation in Ireland is now contributing to reducing grid demand, especially during the summer months. This is likely to be adding to the downward momentum on spot power prices now. While there is still nervousness in the markets, of late particularly around the extent of upcoming Norwegian gas pipeline maintenance, we should expect to see prices remain near current levels, at least until the winter season.

Gas – Pricing & Supply

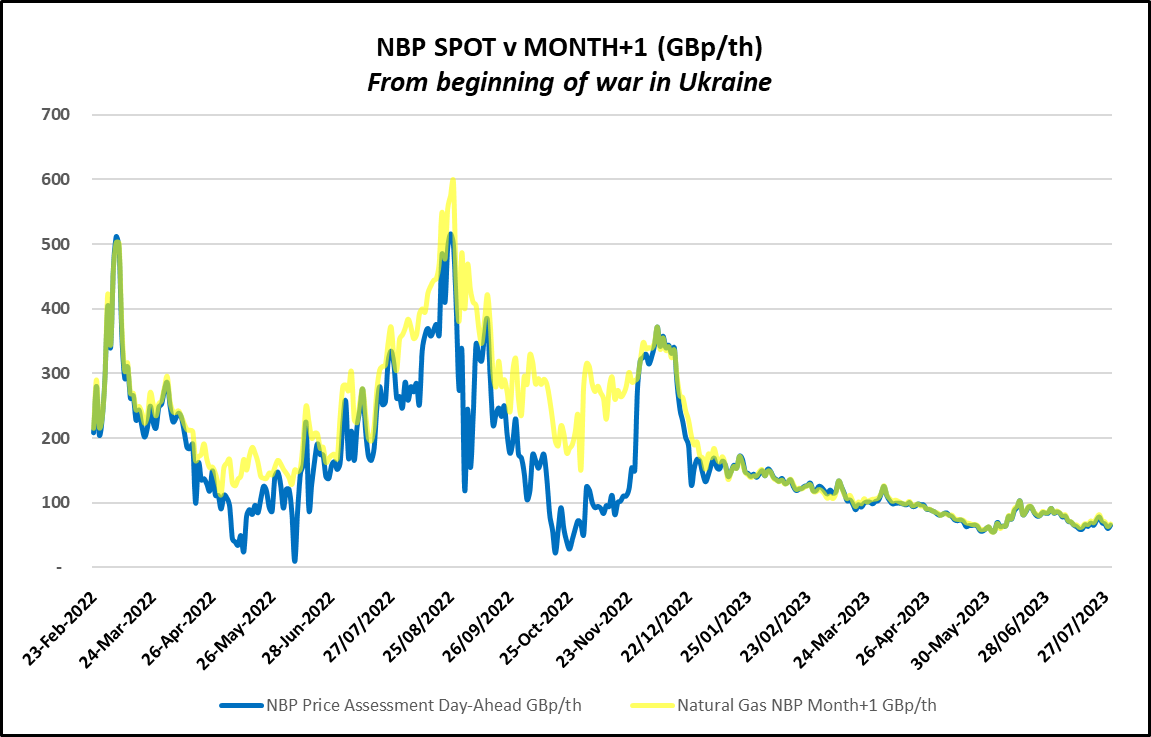

- Near curve NBP contracts saw a significant spike mid-month, mostly connected with lower wind level expectations and uncertainty around the extent of planned outages on Norwegian gas assets for the month of August.

- Spot prices do remain much steadier than at this time last year, and month+1 British gas contracts remain at levels not seen since before Russia’s invasion of the Ukraine in March 2022.

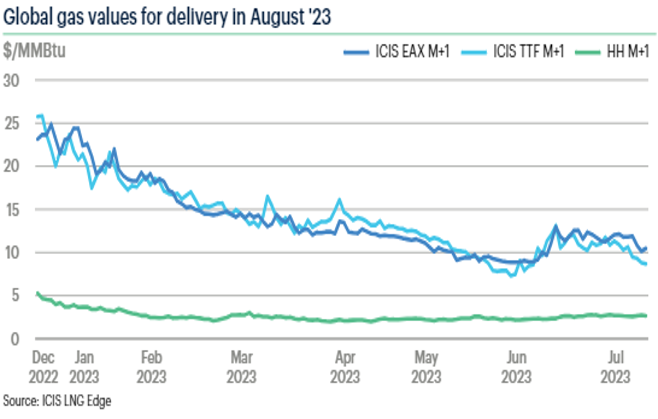

- Supply of LNG was abundant during 2022, when the premium on European gas prices was far higher than that on Asian LNG prices. There is concern now that, with Asian LNG prices creeping higher than the TTF (Europe’s benchmark gas price), supply may redirect to the Asian continent.

- Reports of sluggish economic activity in China may go some way to closing that gap soon, but the TTF price will need to readjust and remain at a level not too far off the Asian LNG price, in order to attract floating cargoes here, if the current trend continues.

- If gas prices in the US remain lower, that will encourage US LNG exports. Price will go a long way to determining the destination of that US LNG.

Gas – Consumption & Storage

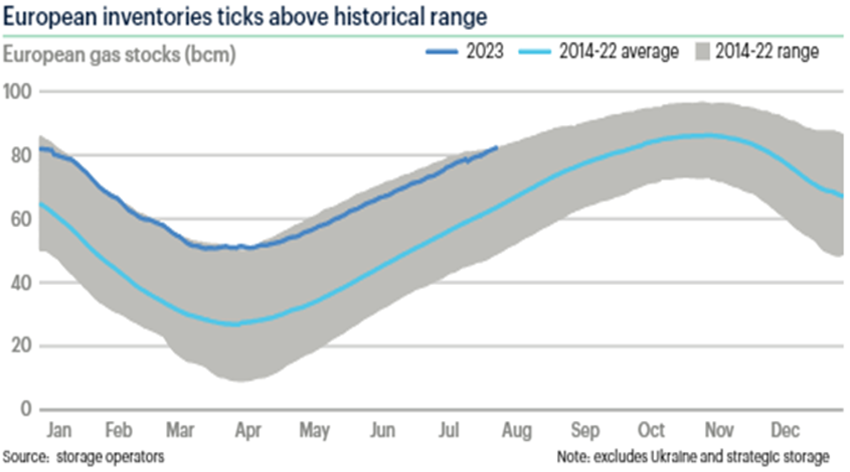

- European storage were above 80% full at end of July. This is higher than at any point in the last 10 years and means that aggregated storage is on target to surpass EU mandated targets, well ahead of winter.

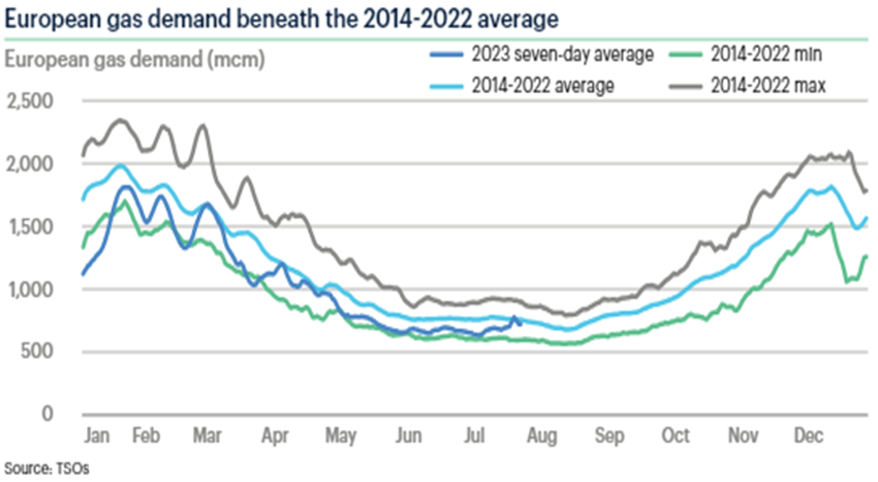

Gas demand did pick up in July, as the intense heatwave in Southern Europe increased the need for gas fired cooling. However, demand remains below the 10-year average.

Gas demand did pick up in July, as the intense heatwave in Southern Europe increased the need for gas fired cooling. However, demand remains below the 10-year average.

July Review – EU Market Reform

After the withdrawal of Russian pipeline gas in 2022, European gas prices are, now more than ever, impacted by events effecting the largest actors in the international gas supply network. Here are few key insights from July that are likely to impact on global gas supply and pricing.

- The US economy is at a crossroads, where nobody really knows whether the short-to-mid-term outlook is bright or bleak. If recent signs of cooling of inflation, coupled with a strong labor market, leads to the US avoiding an expected recession, then improving sentiment around the future of the economy should lead to an uptick in US gas prices, which are currently near all time lows. This positive turn of events would also incetivise gas production there and, in turn, increase supply.

- If the current view on China, which shows sluggish economic activity there of late, continues and the US does in fact slip into recession, that should bring downward price pressure to global energy commodity prices; but at what cost.

- Reported by Reuters in July: Brazil has increased hydroelectric generation to near-record rates in 2022 and 2023, thus reducing the need to import LNG by close to 70%. Brazil is a huge consumer of energy and most of that LNG would have come from the US. That has freed up large volumes of LNG, to plug the gap left by Russian pipeline gas in the European grid. The outcome of this recent weather pattern, in a country far away from Europe, is a reminder of how dependent European gas prices now are on global weather conditions.

Renewables

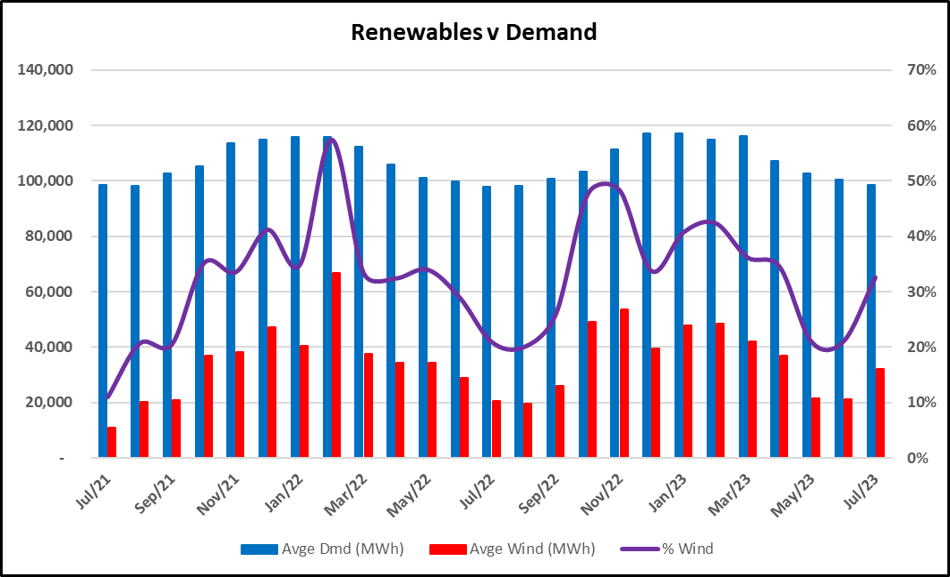

Wind generation contributed an average of 33% of the Irish Generation Mix across the month.

This is quite high compared with July averages and follows 2 consecutive months of just 21% Wind Generation in May and June. The impact of the increased wind levels on the decreased cost of power in July is notable

Wind levels were particularly high in the first half of the month, and then in the final days of the month. The graph below shows that on the days when the wind was calm the price of power in the Day Ahead Market spiked.

Generation Capacity

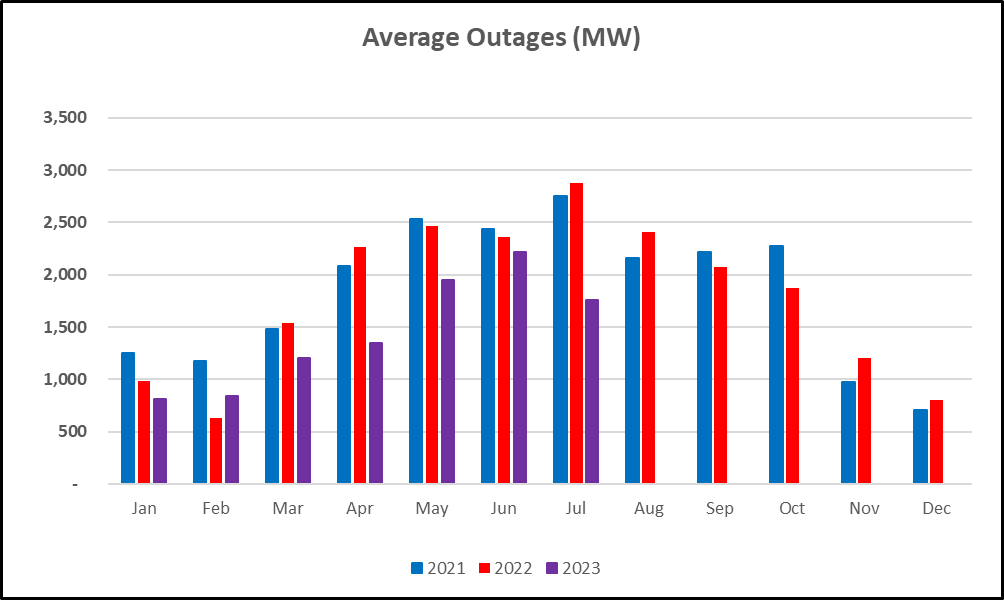

- Outages were much lower than previous years in July 2023, although there was an amber alert on the system on 10th July, due to a generation shortfall in Northern Ireland. That alert was an isolated case, and only remained in place for around 4 hours.

Forecasts – Power Forward Prices

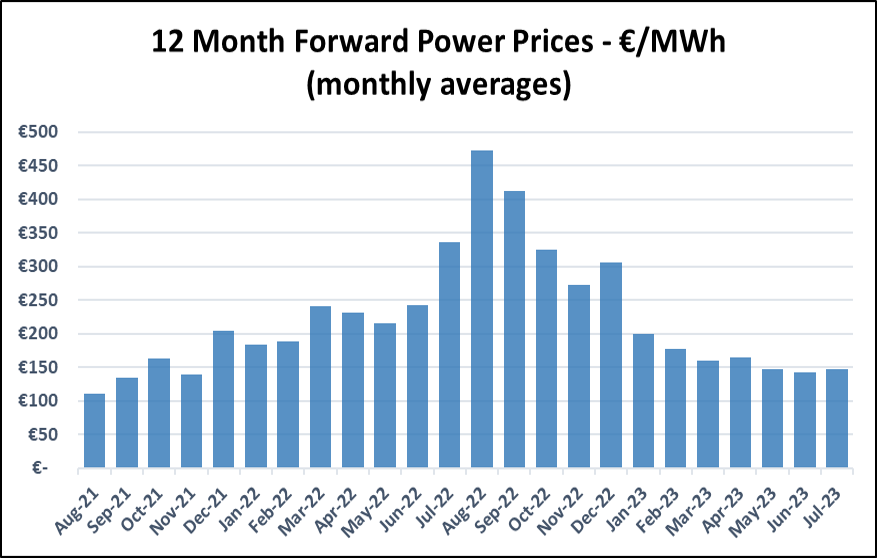

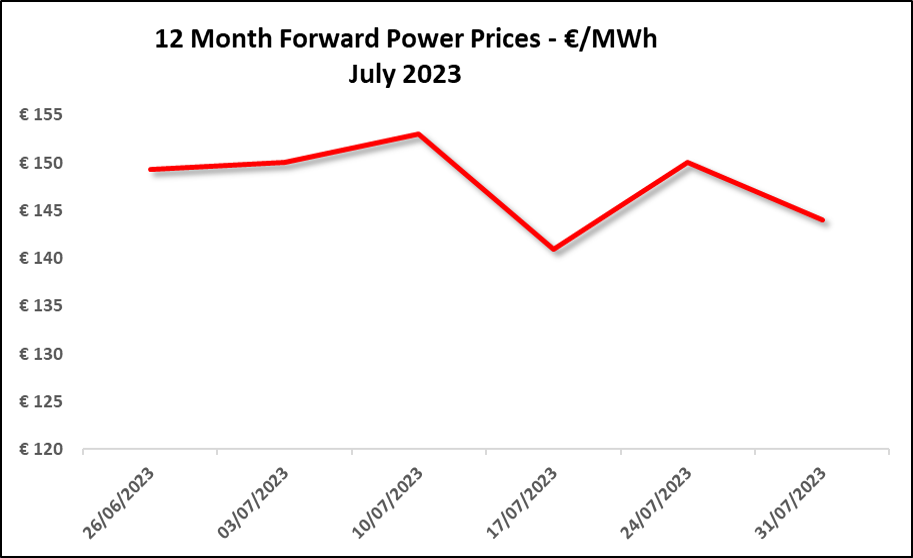

- Although spot power prices have fallen significantly since June, the story around forward price expectations is a little different. Our 12-month forward price estimate enetered the month at €150/MWh and came through the other end at €145/MWh.

- Prices are moving in the right direction, as Europe adjusts to new energy realities, but the stubbornness of future price levels tell us that the market is still carrying a significant risk premium into the future.

- Forward prices are still approximately 2.5x the previously accepted norms.

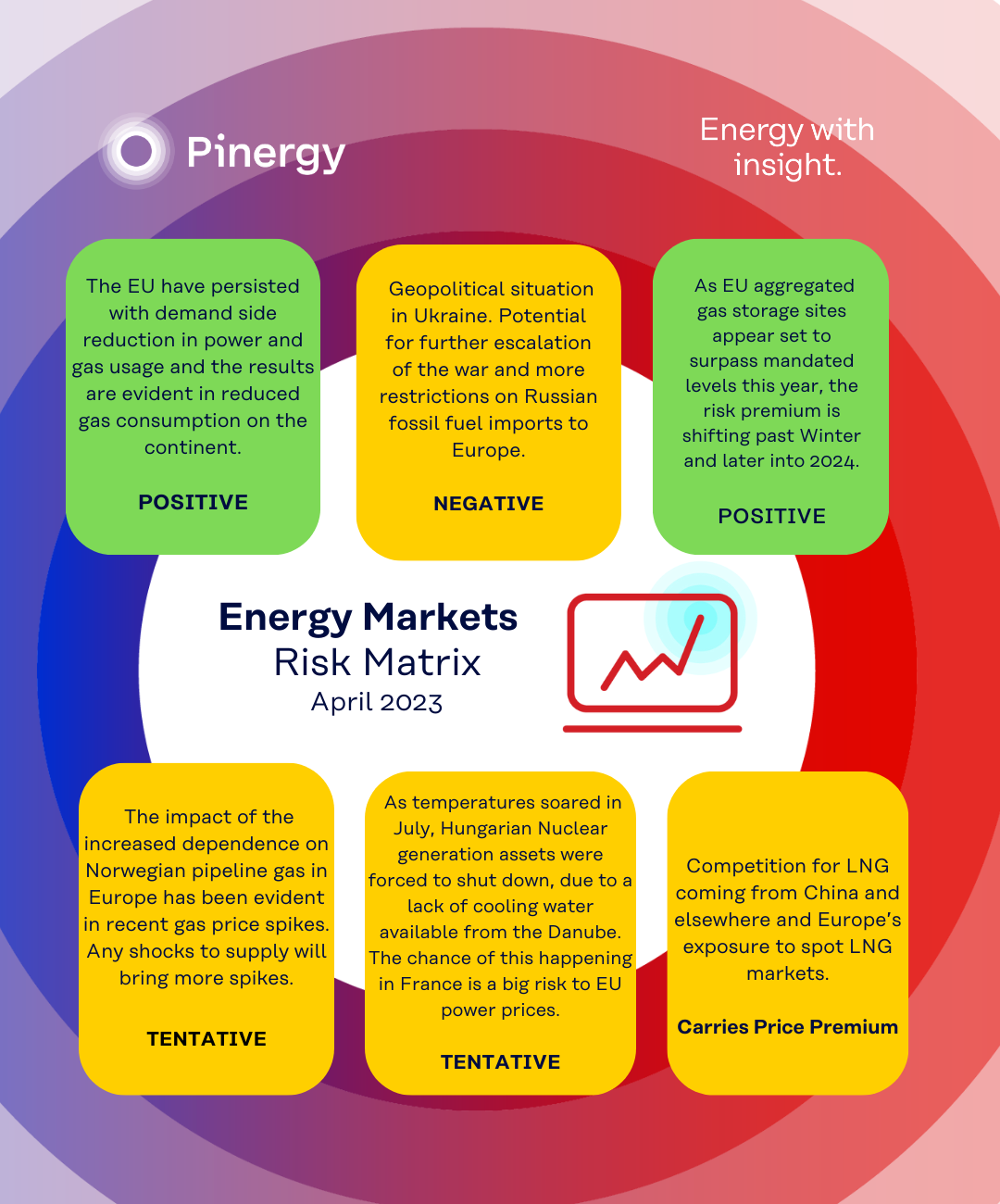

Pinergy Risk Matrix

We have compiled a list of the key factors we feel have the highest potential to influence power prices over the coming 12 months and rated as follows:

Green = Price reducing impact and highly probable.

Amber = Risk of increased power prices and of lower concern.

Red = Significant risk to 12 month forward price outlook, with medium to high probability.